Serenity now: Beachman's financial plan

HowTos: How I constructed and execute my personal finance and early retirement plan

I first wrote about my overall financial plan in May 2022. We were just done with the Q1 earnings season and investors started realizing that interest rate hikes were changing the macro landscape and forward fortunes of companies we owned. The SP 500 had already fallen 14% YTD and was threatening to go lower. Panic and fear started setting in quickly.

Last weekend and again this weekend I noticed a similar, significant increase in fear, uncertainty and doubt (FUD) on several online investing forums and on social media. SIVB, Signature and Silvergate bank collapses, more regional banks in trouble?, Credit Suisse backstop efforts, surge in usage of the Fed’s discount window to shore up liquidity, recession coming? deep or shallow recession? disinflation or stagflation? is QE back on?, is QT done?, end of banking as we know it?, crypto going to the moon?, riots on the street?, are we on the precipice of a major market crash?

A sign of the times - people are worried about their futures, their portfolios and looking for answers and information.

And I will be honest, I was a little worried too, both last year and now. However, every time, concerns start creeping up in my mind, I go back to my financial plan construct and peace sets back in.

My financial plan always gives me…Serenity now!

About four years ago, I found myself giving my 29-year old cousin some financial advice. He asked me several basic questions on how to save, invest etc. Below, is what I shared with him then.

P.S. I recently asked him about that conversation and he still has the little sticky note with the diagram in his wallet. He is now engaged, soon to be married and well on his way to putting many of these elements in place for his own financial security.

Beachman's financial plan

I have been managing my personal finances since the age of 24. I learned from my father, a few good books, some of my more experienced friends and a constant urge to read, listen and watch informative, educative financial management content. There is a lot of good, free content out there and there certainly is a bunch of crap too. The challenge is finding the nuggets and avoiding the not-so-good stuff.

My graduate MBA degree as well as decades in business strategy, product engineering and new markets development helped improve my understanding at both micro and macro levels.

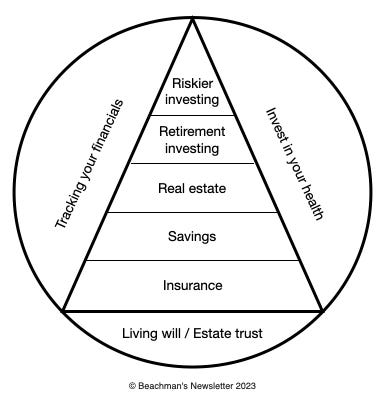

I think about my personal finances in terms of the diagram depicted below.

Each part of this diagram is important in its own way. It is strongly advised to establish the outer and the lower layers first before taking on a higher layer in the pyramid. This ensures that one has a strong base upon which to build, learn and manage risk.

Many people will skip the foundational elements in the thirst (FOMO) for juicy investing returns. This erodes their ability to handle volatility when it hits their portfolio and they lose sleep at night, they make hasty erroneous choices and may even lose interest and hope. I, too, have made some of these mistakes in my early investing days and lost several thousands of $ making ill-informed decisions. It left me disappointed in myself and I lost interest in taking an active role in my investment for many years. Today, I rue not only those faulty investments, but also the loss of compounding returns if I had not walked away from investing in disgust.

My life goals have always centered around keeping my family safe, healthy and happy, building enough wealth to fund my family’s current and future goals, ensuring our ability to weather a financial storm, if it hits us and creating a financial and legal structure that will continue to serve my family when I die.

Some of the key elements in my financial plan depicted above:

I track our family finances using Quicken. It creates weekly/monthly habits of logging income and expenses, tracking bills and payments, setting up and sticking to budgets. All these actions result in a deeper, accurate awareness of our financial situation at all times

Investing in your health is self-explanatory…staying active, working out, eating healthy. Actions that one takes at a younger age will pay dividends later in life as the years take their toll on our bodies

Setting up a living will is easy these days. Establishing an estate trust costs a little in legal fees, but tremendously simplifies the process and reduces the cost to your heirs when you pass away. Do it for your loved ones

Apart from home and automobile insurance, we have a whole life insurance policy that covers me and a term life insurance policy covering my wife

We have about 3-5 years worth of annual expenses sitting in a savings account that we can dip into if the markets go to shit. This is the best sleep-soundly medicine for an early-retiree like me

Our real estate holdings include a home in the midwest U.S. and an apartment in Puerto Rico. Both these homes were bought when the real estate market in those locations were depressed. Our mortgage rates are fixed and reasonable

Throughout our careers, we saved and invested, often and a lot. Our base savings target was always 25% of our income. Some years it was higher and some years it was lower. But socking away 25% of our income every year resulted in a steady growth of our investment portfolio that enabled my early retirement at the age of 50

I love the F.I.R.E (financially independent retire early) movement and learned much from their teachings. We never embraced all of their concepts to the extent that they preach, but we found a good balance between living a good life (travel, entertainment etc.) and saving as much as we could all the time

About 85-95% of our investments are in long term, high conviction holdings. This allows me to invest the remaining 5-15% of our portfolio in more risky, potentially-higher return stuff such as emerging tech companies, crypto, short term trades etc

Conclusion

So that’s Beachman’s financial plan in a nutshell.

As I mentioned above, each portion of this plan has a role to plan in my family’s financial future. Other than the top of the pyramid (riskier investments), nothing should be skipped or ignored.

If you are just starting out on this journey, at first glance, it might seem overwhelming…too many things to get in place….so many financial habits to inculcate. I did not do all of this at once. It took many years to establish this plan and its various elements.

So take it one step at a time, figure out your life goals and priorities and make an investment in your family’s future.

Hi Beachman, I too am interested in a bit more about your statement, “About 85-95% of our investments are in long term, high conviction holdings.” Are these separate investments from what’s tracked in this newsletter? The reason I’m interested is that I am realizing I weighted far too heavily on riskier investments. I took a huge loss, but still hold many. I am looking for some help on transitioning to high conviction foundational stocks for the long term. I’m caught between missing out on rebounds, and being too inexperienced to determine what investments will lay a solid, high conviction foundation that I won’t stress over. Any further suggestions?

Hi, thanks. Is there already a post where you elaborate on the "Retirement Investing" layer?

Thanks!