Thus far, it has been a complicated Q1 earnings season.

Almost 80% of the SP500 companies have reported with an average earnings beat of +9.3%. This is higher than the 5-year average beat and the 10-year average beat. The SP500 is arguably the strongest stock market index in the world and these 500 companies represent the best businesses where investors can put their money to work.

But here come the complications that I alluded to. Q1 reports measure business performance for the first 3 months of the year…well before we started dealing with tariff and trade war shenanigans. If we consider where the economy is heading, the picture does not look consistently healthy.

Mega caps like MSFT, META and GOOG reported strength.

Consumer facing companies like AMZN, MCD, ABNB, BLOCK, SBUX and CMG gave out warnings.

Some tech sectors like cybersecurity are showing resilience.

Others like data management platforms are cutting forward outlooks.

Several companies like TSLA, GM, F and DAL have completely pulled back their 2025 guidance.

A very confusing and divergent landscape…

Welcome to the Beachman community, where we follow the most pertinent market signals that you need to know as an investor…AND…the context and the key takeaway for each of these developments.

Our best pricing of the year, our Mother’s Day sale, is now live for just a short time. Upgrade to an annual subscription to lock in our lowest rate forever.

If you are a long term investor and parent like me, you have multiple things competing for your time and attention. You would like to manage your personal finances effectively while investing smartly to build wealth and fund your life’s goals.

The last few years have amplified the amount and volume of “noise” that is being thrown at us. This newsletter attempts to cut through the crap out there.

I strive to keep my writing brief, actionable and to the point so that you can digest it in a few minutes. My goal is to increase your understanding and provide actionable insight. I use forward-looking and backward-looking trends for analyzing company fundamentals. This approach helped me buy NVDA at the 2022 lows. My top 2023 pick became my 9th multi-bagger in a short 6 months. My top 2024 pick became my 15th multi-bagger in just 3 months. And my latest 2025 pick is well on its way to joining the club.

Today, we will discuss Q1 earnings for two Beachman stock picks for 2025.

We will take a look at the most interesting positives from the reports, the key risks that could derail them, valuations and the bottomline. As always, I will give you the most important highlights along with actionable insights…”actionable” being the key word here. I will also tell you if the stock will remain on or be struck off my Beachman’s Picks for 2025 list. And you can always find my preferred buy points, trim points and technical signals in the portfolio file pinned here.

Table of contents

AAPL Q1 earnings report

META Q1 earnings report

For short term trade ideas, check out Beachman’s Salty Trades.

On the daily, you can find Beachman in four places…

Beachman’s Substack chat line here

Beachman’s Substack feed here

Beachman’s X feed here

Beachman’s Threads feed here

Please check out the must-reads listed on the About page and the Roadmap page.

AAPL Q1 earnings report

In the face of tariff related chaos, AAPL adapted. They tweaked their supply chain in real time to ensure steady supply of product as consumers pulled forward purchasing of their devices in anticipation of higher prices later in 2025. This led to a decent Q1 earnings report, however the rest of the year looks a bit bleaker.

AAPL improved their fundamentals at 7 points, while forward growth scored weakly at 2 and valuations remain elevated at 1 point.

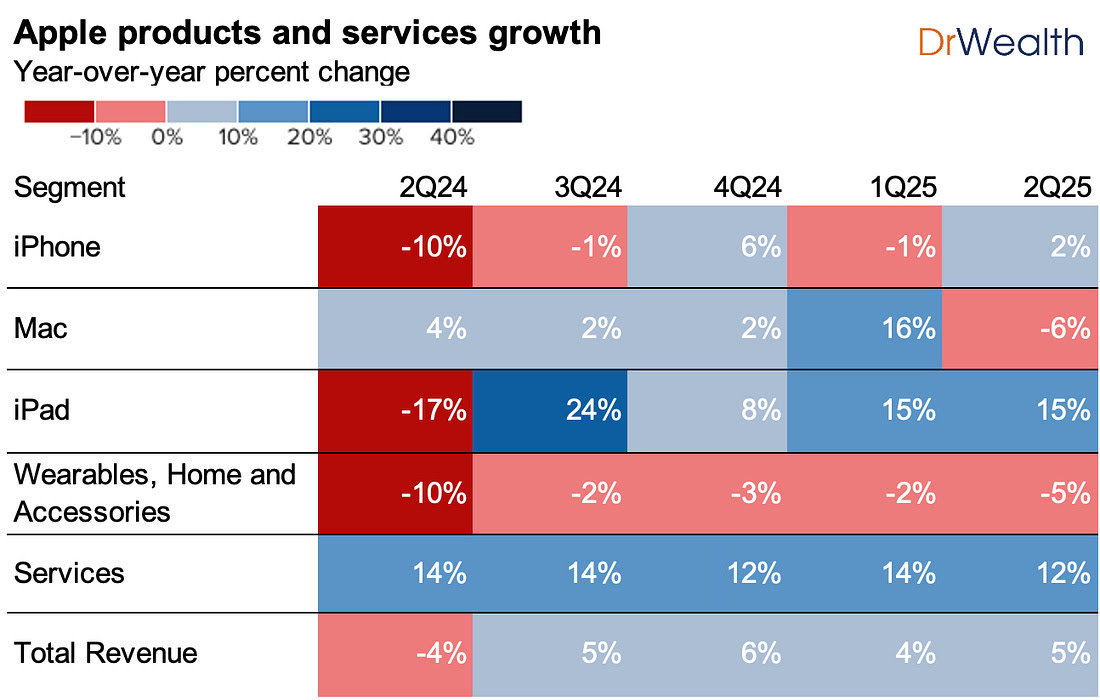

They posted Q1 revenue of $95.4B +5% yoy, beating analyst estimates on the top line (revenues) and bottom line (earnings). Services revenue reached a new all-time high of $26.6B +12% yoy, showing strength in all geographies. iPad sales was the bright spot in product sales, coming in at +15% yoy in Q1. AAPL’s installed base of active devices is more than 2.35B globally. They announced a new $100B share repurchase program for the next 4 quarters, which follows $110B of stock buy backs over the past 12 months. It is becoming harder to truly understand how much of AAPL’s revenues are pure AI related because AI is becoming more infused in all their products and services offerings.

Apple's supply chain is still more concentrated in China and Taiwan (62% of product manufacturing representing about 50% of total revenue), as they continue to diversify operations to India, Vietnam and the US. In Q1, sales of products like Wearables, Home and Accessories declined -5% yoy to $7.5B, missing estimates by -7%. Services revenue also slightly missed analyst estimates. Net sales in Greater China were down -2% yoy, missing estimates by -5%. China represents about 17% of their total sales today. Looking ahead, the guidance for the June quarter projects low to mid-single digit…about 4% yoy revenue growth and a gross margin of about 46%, both of which missed Wall Street expectations. The lower margin guidance includes an estimated -$900M Q2 impact from US tariffs. Additionally, Apple indicated that some of the more personal Siri features related to Apple Intelligence are taking longer than expected and requiring more time to meet their quality standards…these will be delayed out further into 2025 / 2026. Regulatory pressures, such as those from the EU and U.S. antitrust cases, also threaten to erode aspects of Apple's closed ecosystem.

Morningstar maintained their fair market value at $200 implying a current PE of 27 and a forward PE of 23…this as compared to the SP500's PE of 23. Considering their enterprise value, gross margins and forward growth, the stock is extremely overvalued right now, even after the recent -7% post-earnings price drop.

I own AAPL for 4 key reasons: 1. Its premium ecosystem of tightly integrated hardware, software and services. The company's "walled garden" and flywheel business model generates significant pricing power, switching costs and a strong network effect. This is further supported by Apple's design prowess, their in-house chip development and a large developer network. 2. Apple is at the forefront of consumer-facing AI…as they build it, people will come. 3. Apple's robust balance sheet enables it to return significant value back to shareholders through dividends and stock buybacks. They have repurchased almost $700B in stock over the past 10 years, which is greater than the market cap of 488 companies in the SP500 index. 4. AAPL stock serves as a barbell hedge in my portfolio against my other high-beta holdings and in times of market turmoil.

2025 will be marked by volatile markets and global macro potholes. During such times, mega caps like AAPL can survive due to their fundamental strength and they could even take more market share from younger emerging rivals by actively deploying their cash reserves into new product development and acquisitions. We saw how this happened in 2022. Let me close by repeating these key metrics: the services business generates $100B+ in annual revenues, across 1B+ paid subscriptions growing at a +27% CAGR, with 75% gross margins, on an installed base of 2.35B+ devices globally. And they are just in the first innings of their consumer AI rollout.

Bottomline, AAPL continues to serve as a foundational portion of my investment portfolio and it will remain on my Beach Picks 2025 list.

META Q1 earnings report

That was a solid earnings report from META in Q1. Mega caps stocks are showing their resilience in the face of trade wars and recessionary negatives.

META’s scores remained relatively stable at 7 for fundamentals, 3 for growth and a higher 6 for valuation.

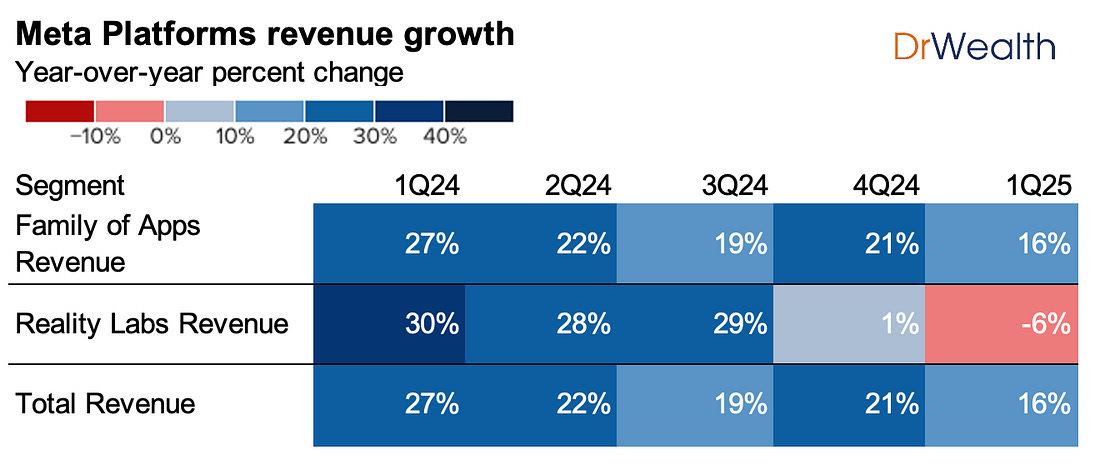

In Q1, META’s revenue grew by +16% yoy to $42B exceeding consensus estimates. Earnings also beat expectations, growing +37% yoy. The company's daily active users (DAUs) grew +6% yoy to 3.43B…that’s close to half the global population and growing faster than the average 5% in prior quarters. Advertising pricing showed strength, increasing by +10% yoy, indicating improved ad performance and advertiser demand. Margins remain very strong with an 82% gross margin and a 39% net margin…39 cents of every revenue dollar is profit! They reported that the emerging product line, the Ray-Ban Meta AI Glasses have tripled in sales over the past year. META’s Q2 revenues are estimated to grow at +13% yoy while further growth is estimated at a CAGR of +12% for the next 4-5 years with higher monetization opportunity in developing markets.

Despite the strong earnings results, I always try to understand risks and areas of concern. Along those lines, I noticed that revenue growth decelerated from +27% in the same quarter a year ago. Guidance for Q2 2025 anticipates a further sequential deceleration in revenue growth, approximately +13% yoy growth at the midpoint. Ad impressions growth slowed considerably to just +5% yoy across the family of apps, down from +20% in the prior year quarter. They saw this slowdown across all geographic markets. Even average revenue per user grew at +10% yoy which was about 45% lower than one year ago. Meanwhile, META bumped up their 2025 capex spending plans to $65B even though the Reality Labs segment continues to incur significant losses. Similar to its peers, META faces regulatory challenges in the EU and the US, while uncertainty exists around future macroeconomic conditions. Tariffs and trade wars along with the rejiggering of supply chains could hurt their future ad revenue. About 11% of their revenue is China related…this is a pretty significant risk in current times.

Morningstar held their fair market value at $770, implying a forward PE ratio of 30. Their current PE is 23 which seems slightly elevated but not by much, imo. While there could be some short term revenue and earnings contraction, a pull back in the stock could be an interesting buy the dip opportunity…given META’s strong market share and future AI prospects. They are one of the best examples of AI in actual business use…that is generating incremental growth today.

Astute investors cannot ignore META’s ad market strength with almost 3.5B global users and generating about $200B in annual revenues with an 82% gross margin. To put some context around this point, about 5B people in the world have access to the internet, implying that about 75% of this global cohort are META DAUs. This is the core investment thesis in the company - ad-tech leadership catalyzed by AI capabilities predicated on a massive user base. AI has the potential to improve ad targeting and recommendations, enhance user engagement and potentially drive internal productivity gains. Today, Facebook and Instagram bring in most of META’s ad revenue while they have barely scratched the surface to drive more top line growth in the WhatsApp and Threads apps. META’s fundamentals are very strong with high and expanding margins and consistent cash flows that strengthen their balance sheet quarter over quarter. They have an active $50B share repurchase program in place today.

Bottomline, META is in a unique position of strength heading into the rest of 2025 and 2026 and it will stay on my Beach Pick 2025 list.

Much more to come in this earnings season…many more stocks that we will analyze. A small number…less than a handful…of these will get upgraded to my Beach Picks 2025 list.

We want to have this short list ready...at hand…so that we know what we to buy when the opportunity comes along.

Cheers.