Market Whispers - You shall not pass!

Markets: Beachman's portfolio tactics based on his read of the markets

I would like to wish all you mamas out there a very happy Mothers Day.

You are loved, you are appreciated and you seriously rock!

P.S. If you are not a mom, please don’t forget to do something special for the mothers in your life. Remember, your mom was the first person to love you even before you were born.

We have had a +15% increase in readership since the beginning of the year. Welcome to the beach! I am glad to have you here. Let’s learn from each other and, together, make 2025 another year of leading returns for our portfolios.

Before we dive into this week’s market review, let me orient you on how to get the most out of my writings:

You can always find my portfolio file pinned to the top of the Portfolio section here. It contains my current holdings, all my Beach Picks for 2025, preferred buy points, trim points, valuation metrics, hedges, stock scores etc. This gets updated every weekend…look for the most recent date in the title.

My 2025 market roadmap is pinned in the Market section here. This is my forecast for how I believe the market will perform for the next 3-5 quarters. Make note of when I expect a correction or upside movements.

I actively follow the business performance of about 50 growth stocks of interest and I score them every quarter…looking for the best stocks to own. These are listed in the portfolio file mentioned above.

On a daily basis, I post highly relevant content in the chat space here, including key market levels to watch, stock charts with buy/sell signals, overbought/oversold indicators, buy/trim/sell price levels etc. Every Sunday, you will receive an email with a direct link to the new chat thread for the upcoming week.

Every time I make a buy or a trim or a sell or put on or take off a hedge, I alert readers in real time in the chat space mentioned above.

All portfolio changes are logged in chronological order in the Alerts section here about 24-48 hours later.

We have a very active community that discusses markets, macro and stocks in the chat space. This is a no-FOMO, astute group of investors who share their ideas, perspectives and portfolios. So join us there every day, read and contribute your thoughts and questions.

Last, but not the least, please read the About page which includes a roadmap to my Substack.

Now let’s get back to our regular programming…

Welcome to the Beachman community, where we follow the most pertinent market signals that you need to know as an investor…AND…the context and the key takeaway for each of these developments.

Our best pricing of the year, our Mother’s Day sale, wraps up shortly. Upgrade to an annual subscription to lock in our lowest rate forever.

Thank you for your time and for your readership. We continue to grow because you support us, you share our work with others, you contribute to and nurture our community in many ways. So please keep those likes, comments and questions coming. Every engagement feeds into the algorithm that helps others find our work.

Beachman’s Investing Brief is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Table of contents

Overall market conditions

Beachman recommends

Beachman’s portfolio stance

Important dates

Market signals

Beachman’s plan

Overall market conditions

Trend: Bumping up against top side resistance.

Risk level: High.

Investor sentiment: Greed.

Beachman recommends

Each week, I share a recommendation for an app, a book, a website, a podcast, a publication, a movie…anything that I find interesting and useful from an investing and financial management perspective. I don’t get paid to do this. Beachman’s Newsletter has and always will be an ad-free publication. So here goes…

Google AI mode, Grok & Siri

There are many AI tools and copilots out there. Most of them are ok, while just a few are actually useful. Over time, I have narrowed down my preference to just three of them. Google search has an AI mode that is now available in beta. This AI mode uses reasoning and planning to handle complex queries to generate more accurate and comprehensive responses in a conversational manner. Grok is a similar tool that I use to look up financial information on X. Finally, Siri on my iPhone is much improved and effective now. I use these three AI tools regularly throughout my day…most of the time I just talk to them to get what I am looking for.

Beachman’s portfolio stance

60% long. 36% hedged.

Established most of my necessary hedges before the Summer.

Done raising cash in line with my 2025 market roadmap.

4 trades in place (See current trades at Beachman’s Salty Trades).

Important dates

May 13th - CPI retail inflation report.

May 15th - PPI wholesale inflation report.

May 16th - Monthly options expiration.

May 29th - Q1 GDP update.

For short term trade ideas, check out Beachman’s Salty Trades.

On the daily, you can find Beachman in four places…

Beachman’s Substack chat line here

Beachman’s Substack feed here

Beachman’s X feed here

Beachman’s Threads feed here

Please check out the must-reads listed on the About page and the Roadmap page.

Market signals

Last week, I was a bit stressed because my portfolio has a high cash allocation and was about 38% hedged then…and the markets kept rising and rising. I identified three triggers to change my ST market thesis. If at least 2 of these 3 hit then I would remove large portions of my hedges and look for opportunities to go more long i.e. deploy some of my cash.

For two weeks now, only one of these three triggers have fired. Markets kept getting close to pulling me to the bullish side of the boat, but they kept coming up short. I posted additional thoughts on the matter here…

What else am I watching?

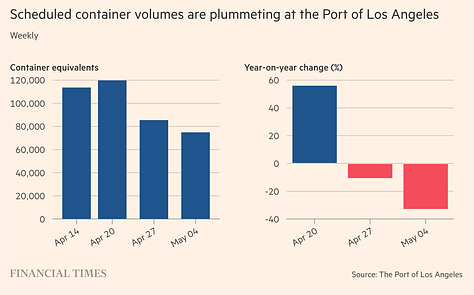

Transportation lines - ships, containers, trains, trucks etc. are running on much lower than normal volume. The front running of tariffs and pre-ordering of goods from manufacturers seems to be tapering off. There seems to be less inventory coming through the pipelines behind the recent surge. This does not bode well for the upcoming back-to-school, halloween and holiday shopping seasons. Supply chains, especially from China, are grinding to a slow trickle.

Beachman’s plan

So what’s my plan in all of this? How am I navigating these markets now?

Here is how I intend to move forward…