Market whispers - Let's take advantage of this tariff "clarity"

Markets: Beachman's portfolio tactics based on his read of the markets

Markets and portfolios just got “tariffed”. Trump stood on the White House lawn and used a variation of his famous TV tagline…”You’re tariffed!”.

We knew this was coming. We knew for days and yet many investors held out hope that the tariffs would be lower than feared…that Trump would not want the market to crash…that he would give us a new Trump PUT…aka good news to take the market higher.

Tbh, while I was expecting a strong tariff announcement, even I was shocked by how high some of the new tariffs were e.g. China tariffs at 54%!

Over the past few weeks, while institutions and large funds were divesting themselves of macro-risky sectors, retail investors were piling in and buying the dip (B.T.D.).

In the Beachman community, we held off. We don’t blindly BTD here. We don’t ignore macro just because “we cannot control it”. We don’t bury our heads in the sand hoping for the worst to pass. Hope is not a strategy on our beach.

In fact, we listened to the words of the new administration and we took them seriously. We trimmed when valuations were inflated in Jan and Feb. We paid attention to Q4 earnings calls and noticed that very few companies and analysts adjusted their full year 2025 outlooks and guidance lower in anticipation of worsening macro conditions - lower growth, more tariffs, weaker consumer spending. So we trimmed and raised cash.

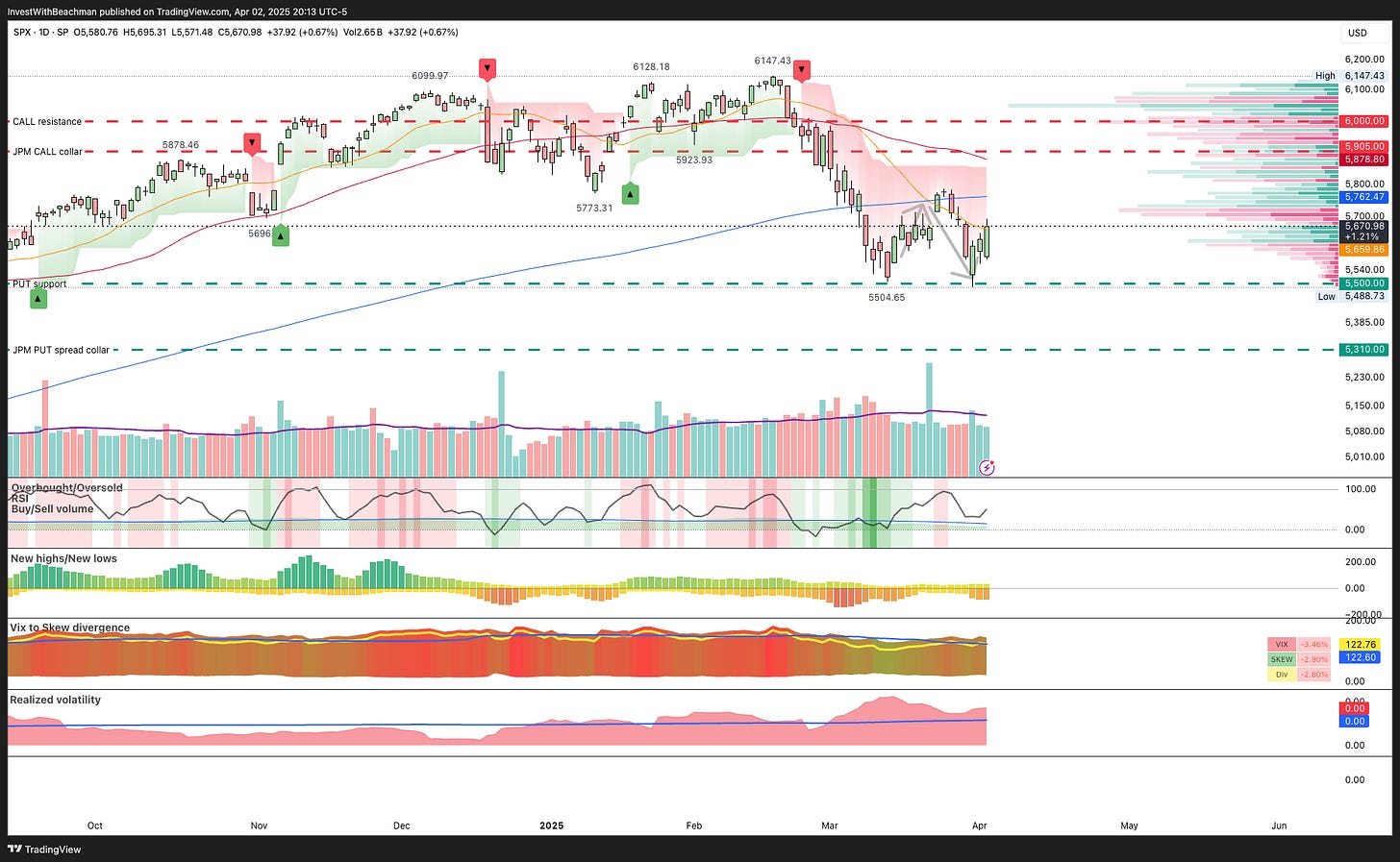

Now, this is the SP500 chart that we have been using as a roadmap since the beginning of the year. Notice those two grey arrows? I drew those arrows in mid-Feb and left them on the chart since then. We anticipated strong downside support at the 5,500 to 5,600 region and we surgically backed up the truck (B.U.T.T.ed) during the first half of March. We waited for the swing higher, expecting markets to struggle to get past 5,700. We took healthy gains off the table in end-March. This time we raised even more cash…now +30% of our portfolio. Then we waited again because we knew that markets would struggle again.

There was no high-fiving on the beach or “you nailed it!” celebrations.

There is no magic in our approach. It is based on analyzing company fundamentals, listening to earnings calls, tracking market health and options trading data, not believing everything you read on the internet, not FOMOing into stocks because a fintwit or YouTuber or a CNBC “expert” “perma-bull(y)ed” us into buying the dip because stocks can only go up and to the right.

2025 is not going to be like the past few 20%+ bull years. Anyone ignoring market signals and macro fundamentals is…either lazy or too busy or paralyzed by fear or perhaps trying to B.S. their way ahead.

This is not the time to F. A. F. O.

Welcome to the Beachman community, where we follow the most pertinent market signals that you need to know as an investor…AND…the context and the key takeaway for each of these developments.

Our best pricing of the year, our Mother’s Day sale, is coming in a few weeks. Now is the perfect time to try out our paid content so that you are ready to upgrade to an annual subscription when the sale hits.

Thank you for your time and for your readership. We continue to grow because you support us, you share our work with others, you contribute to and nurture our community in many ways. So please keep those likes, comments and questions coming. Every engagement feeds into the algorithm that helps others find our work.

Beachman’s Investing Brief is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

For short term trade ideas, check out Beachman’s Salty Trades.

On the daily, you can find Beachman in four places…

Beachman’s Substack chat line here

Beachman’s Substack feed here

Beachman’s X feed here

Beachman’s Threads feed here

Please check out the must-reads listed on the About page and the Roadmap page.

What next?

Markets are likely to be in turmoil for the rest of the week. Our portfolios are going to take a hit. Anyone who tells you otherwise is ignoring reality.

So what should we do next?

In my recent post on hedging, I laid out several sleep-well-at-night (SWAT) options. Everyone has to gauge their risk tolerance and find the portfolio management strategy that works for them.

Here is what I am doing:

I laid out my market roadmap for the rest of 2025 and I frequently update it based on fresh macro data and emerging trends.

I added a few more prospective arrows on the SP500 chart above…taking us into the Summer. Let’s see if markets follow these anticipated paths.

Soon we will see a flood of updated SP500 year-end targets, refreshed 2025 company revenue & earnings estimates along with new analyst ratings and stock price targets.

We will pay attention to the perma-bulls, the perma-bears and several others in between because we want to take in a range of opinions and ideas and then decide for ourselves.

Q1 earnings season starts soon and management teams better be ready with crystal clear answers on potential tariff impacts to their business. Anything wishy-washy will punish their stocks.

Currently, I only hold stocks that I want to own in 2025, but I will be on the lookout for new candidates based on Q1 earnings and forward estimates as per #5 above.

I have mapped out my 2025 hedging strategy (new posts coming soon) and will start putting it in place.

Bottomline

Markets hate uncertainty. Now they know (for the most part) which countries, sectors and companies will be hit with tariffs and by how much. These numbers could change with a tweet or a new deal. That said, they can be factored into forward guidance, business outlooks, discounted cash flow analyses and stock price valuations.

I expect some of these tariffs to be lowered via lobbying, negotiations and trade deals. But I do not expect them to go away completely. More on this below…

Some countries will likely push back and retaliate.

We are entering a completely new global trade regime. Things will look different 5 years from now as compared to the past 5 decades.

That said…in the short term, markets will try to find a bottom and look for reasons to go higher. We could get a tradable low, but investors may want to be careful about BTDing or BUTTing just yet.

That’s because I don’t consider tariffs as the biggest market risk in 2025.

I jotted down my thoughts on this matter earlier in the year. I am much more worried about a massive $9T chupacabra that is coming due this year. Federal government spending, DOGE cuts, tariff revenue, fiscal stimuli, tax cuts, debt ceiling, QE, QT, interest rate cuts…they are all closely related to this fast-approaching monster hidden in plain sight. If not resolved quickly and carefully, it will make tariff impacts look like a walk in the park.

And so I am using my rolling 12-month market roadmap to structure and manage my portfolio to minimize my losses and maximize opportunities along the way.

Cheers and good luck out there. We will need it this year.

P.S. In case, you are wondering if the US Feds will come to the rescue with an emergency interest rate cut, think again. It is likely that they will keep interest rates steady through 2025…perhaps 1 rate cut in May/June…because inflation is still high and could go higher due to the new tariffs. Markets and investors cannot count on the Feds doing anything just yet.

Appreciate the update and forward looking analysis. Valid to continue preaching caution. Still too much churn to BTD, unless the rationale is compelling.

The market hates tariffs that part is very clear