Market Whispers - Beachman's mid-year plan: Adapt or GAG!

Markets: Beachman's portfolio tactics based on his read of the markets

A few days ago, I discussed my evolving thinking and approach to investing and trading in this…the Golden Age of the Grift (GAG). If you have not read that post, I recommend giving it a quick perusal here.

Charles Darwin told us that, "It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change."

This advice is perfect for today’s market.

It is not your typical market. This is not your normal economy. This is not your predictable administration.

What is becoming common place these days is that folks in power and friends of folks in the right place are manipulating financial systems to their benefit.

For example, last week, Trump announced higher tariffs on two countries - Brazil and Canada. There is evidence of someone taking large trade positions a couple of hours before the announcements and then closing out those trades shortly after the news came out…walking away with profits of 25%+ in each instance…in a matter of hours.

Over the past 6 months, there are several such anecdotes that one could pin point in terms of time, trades and official announcements.

Now, I might sound bitter in my recent writings with these developments.

I can assure you that I am not. I am not sour nor disappointed nor am I outraged. I don’t have time or energy to be any of these things.

What I am is…clear in my understanding and my thinking about how I need to operate in this new environment.

It is what it is…now let’s figure out how to profit from it.

Read on to understand how…

Welcome to the Beachman community, where we follow the most pertinent market signals that you need to know as an investor…AND…the context and the key takeaway for each of these developments.

Thank you for your time and for your readership. We continue to grow because you support us, you share our work with others, you contribute to and nurture our community in many ways. So please keep those likes, comments and questions coming. Every engagement feeds into the algorithm that helps others find our work.

Beachman’s Investing Brief is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Table of contents

Overall market conditions

Beachman’s portfolio stance

Important dates

Market signals

Beachman’s plan

Change is the only constant

Overall market conditions

Trend: Bumping up against topside resistance.

Risk level: High.

Investor sentiment: Extreme Greed.

Beachman’s portfolio stance

66% long. 47% hedged.

3 trades in place (See current trades at Beachman’s Salty Trades).

Important dates

July 15th - June CPI retail inflation report.

July 16th - June PPI retail inflation report.

July 18th - Monthly options expiration.

Q2 earnings season kicks off - TSM, NFLX, major US banks etc.

For short term trade ideas, check out Beachman’s Salty Trades.

On the daily, you can find Beachman in four places…

Beachman’s Substack chat line here

Beachman’s Substack feed here

Beachman’s X feed here

Beachman’s Threads feed here

Please check out the must-reads listed on the About page and the Roadmap page.

Market signals

US$ is key to where the market goes

As you can see in the chart above the US$ DXY index continues to trend lower…it has been doing this all year. The US$ has been losing value against a basket of global currencies. I felt this effect first hand in the cost of my recent travels to South America and Europe. There are several reasons for this downtrend…the biggest being the shift in US trade policies aka tariffs and the rising US debt & fiscal deficit issue, further worsened by the recent passage of the “Big Beautiful Bill”. The dropping US$ is bullish for companies that do business internationally because it encourages foreign customers to buy more US goods and services…thus propping up sales and profits…which in turn bumps up their stock prices. Inversely, it is bearish for companies that depend on imports into the US because their foreign buying power is reduced. At some point the US$ is bound to reverse course (go higher) which could bring down stock prices. The US administration also needs to prop up the US$ soon in order to achieve their fiscal goals and adequately fund government operations.

Abnormal market trajectory

This Nasdaq 100 (NDX) chart from DeCarley Trading is flashing a warning signal. From 2008, the NDX spend a decade rising about 7,000 points before a large correction took place. After the COVID 2020 period, it rose 10,000 in 20 months before tanking in 2022. Now, the current AI driven rally has put on 12,000 points in 21 months. Money supply or market liquidity has been a key driver for the two most recent rallies. However, now a double-top divergence is showing up in the RSI…similar to the two previous crashes. The big question is whether markets will pay heed or just ignore these technicals.

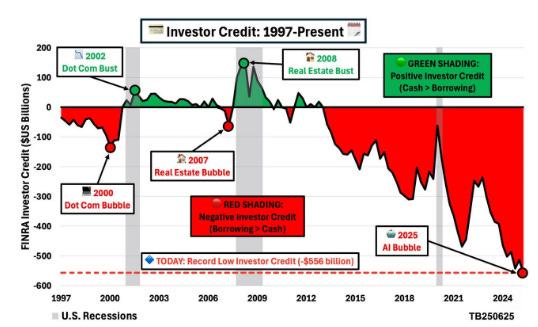

Margin debt

Investor debt is currently at new high record levels, even as compared to previous significant market peaks and valleys. Some readers think that this chart could be flawed because the value of equities have risen several fold since those previous bubbles. Although there is some merit to that point, most well-owned and well-traded stocks are overvalued today when you consider their forward growth and earnings estimates. Additionally, the US$ is in a major downtrend similar to those bear market periods, which further accentuates the risk of investors getting over their skis in this market environment.

Q2 earnings season kicks off

Starting this week, we will get Q2 earnings reports from our favorite companies. As usual, TSM, NFLX and the major US banks kick off the proceedings. Current Q2 GDP estimates reflect a possible pull-forward effect from US tariffs i.e. Many businesses rushed to import materials, parts and finished goods before tariffs came into force. Additionally, consumers purchased more goods in anticipation of higher prices and inflation. Therefore, we should see relatively decent revenue growth along with tepid margin expansion. The higher revenue growth will reflect the elevated consumer spending, while the margin compression should take into consideration the increased pull-forward operational costs. As per Bloomberg, SP500 Q2 earnings will grow only about +2.8% yoy, the lowest increase in 2 years.

Beachman’s plan

So, given these recent signals, how do I plan to navigate the markets now?

Last week, I read some astute words on a trading chat board that perfectly sum up my thinking on the matter…

“I am fairly certain that in a year's time, US stocks will be much lower. Could I be wrong?

Sure, as I always say; a good trader never says never. However, the one thing I won't accept is the notion that the recent stock market strength is signaling something more profound. Markets get it wrong all the time. In fact, the bigger the change, the more difficulty the market has in pricing it appropriately.

Although my base case is that the stock market will roll over shortly, I am prepared for a repeat of 2007. I am not ruling out a run to new highs. The mistake will be assuming you know "for certain" the timing of the coming decline. No one knows the precise timing, and if they tell you they do, just ignore them. All you can do is prepare yourself by looking at the history of past market tops, keep an open mind to a wide range of possibilities, extend your timeframe, and tune out the noise.”

Here is how I intend to move forward…