Market whispers - 2025 likely not a SuperBowl year for markets

Markets: Beachman's portfolio tactics based on his read of the markets

Over the past few months, we added 5 stocks to our portfolio. 4 of them are doing admirably well. The 5th horseman turned out to be a donkeyman and we exited as soon as our investment thesis was broken. I will take this 80% hit rate anyday…this is investing in real life. If you come across an “expert” that is hitting it out of the park…look past the curtain and dig a bit into their failures. Do they discuss them and learn from them or are they busy making excuses and deleting tweets as soon as the stock tanks?

The Beachman community here…is a community of learning…we document our successes and our failures…we identify lessons learned and apply them to future investing decisions. We are constantly evolving and innovating to become better investors without FOMO, laser eyes, YOLOing and fartcoining…

Our last Beach pick is up +25% since we first bought it in Dec…and it is just getting started…because now the market is paying more attention to this company and its future business prospects. We are itching to add a new stock to the portfolio in the next few weeks, but are trying to decide not only which one to pick, but also which current position to cut.

Welcome to the Beachman community, where we follow the most pertinent market signals that you need to know as an investor…AND…the context and the key takeaway for each of these developments.

Beachman’s Investing Brief is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Table of contents

Overall market conditions

Beachman’s portfolio stance

Important dates

Market signals

Bottomline

Overall market conditions

Trend: Bullish & range-bound.

Risk level: Medium.

Investor sentiment: Fearful.

Beachman’s portfolio stance

Mostly long.

3 long trades in place (See current trades at Beachman’s Salty Trades).

Trimmed some overbought stocks to maintain cash-on-hand for specific BTDs.

Important dates

Feb 11th and 12th - US Fed Chair Powell testimony.

Feb 12th - Jan CPI inflation report.

Feb 21st - Monthly options expiration. About $370B in volume. 2x bullish CALL options versus bearish PUT options.

For short term trade ideas, check out Beachman’s Salty Trades.

On the daily, you can find Beachman in three places…

Beachman’s Substack chat line here

Beachman’s Substack feed here

Beachman’s Threads feed here

Please check out the must-reads listed on the About page and the Roadmap page.

Market signals

What will Bessent do?

Last week, we discussed one of the biggest risks to stocks in today’s markets. About $9.5T of US Treasury debt is maturing in 2025 and Treasury Sec. Bessent has some tough decisions to make about how to handle this situation.

As a reminder, when there is a lot more supply of a thing, then prices for that thing drop (economics 101). In this situation, the US bond prices would drop and interest rates would rise because rates are inversely proportional to the price of bonds. When rates rise, especially the 10-year US interest rate, then stocks get revalued lower because the 10-year rate is typically used to calculate the current value of all the future earnings of a company (financial accounting 101).

We are, now, starting to get more clues about how Bessent is thinking of handling the situation. He seems to be focused on bringing down the 10-year interest rate…this will be good for stocks. He is looking at different options…none are easy, painless paths. Some of the ideas include reducing the size of the Federal government, adopting a balanced budget that will reduce the burn rate of US Treasury funds (TGA), lowering the price of oil, selling some US assets (gold?) to reduce the debt and, of course, earning more revenue from tariffs.

Like I said, none of these are easy to do and all of them will introduce some degree of macro pain. What I like is the increased focus on the 10-year rate rather than the FOMC’s short term rate decisions.

Bessent is pursuing an ambitious 3-3-3 plan: annual GDP growth of 3%, budget deficit at 3% of GDP by 2028 (currently $2T deficit at 7% of GDP) and increasing domestic oil production by 3M barrels per day.

For us investors there are three takeaways:

Lower LT rates are generally more bullish for large cap stocks, while small caps are more dependent on ST rates…which could stay elevated for longer.

Keep an eye on that 10-year rate and any related news developments. Everything else is noise and bluster…filter it out and focus on what’s most important.

If Bessent is successful in any or all of his 3-3-3 plan, that will be bullish for the US stock market.

Perhaps one more takeaway…

We need to find the bottom in LT US bonds (TLT) so that we can buy for the upside reversal move.

Markets

The SP500 remains in bull market mode, but still trapped in a narrow range. More stocks making new 52-week highs, but the 52-week lows are gaining traction too. There is upside resistance at 6,165 and downside support at 5,900. Any movement outside these levels will be remarkable and actionable.

Boringly, the Nasdaq is in a similar situation - bullish and range-bound. 510 is the key level to watch for any downside volatility.

Small caps are still trapped below the 50dma due to higher LT interest rates. The selling continues in these stocks.

Both, the US$ (DXY) and 10-year LT interest rates dropped over the past two weeks, providing some respite. However, they are at a fork in the road trying to decide where to go next. The US$ is at similar levels as at the height of the dot com bubble in the early 2000s…we know what happened shortly thereafter.

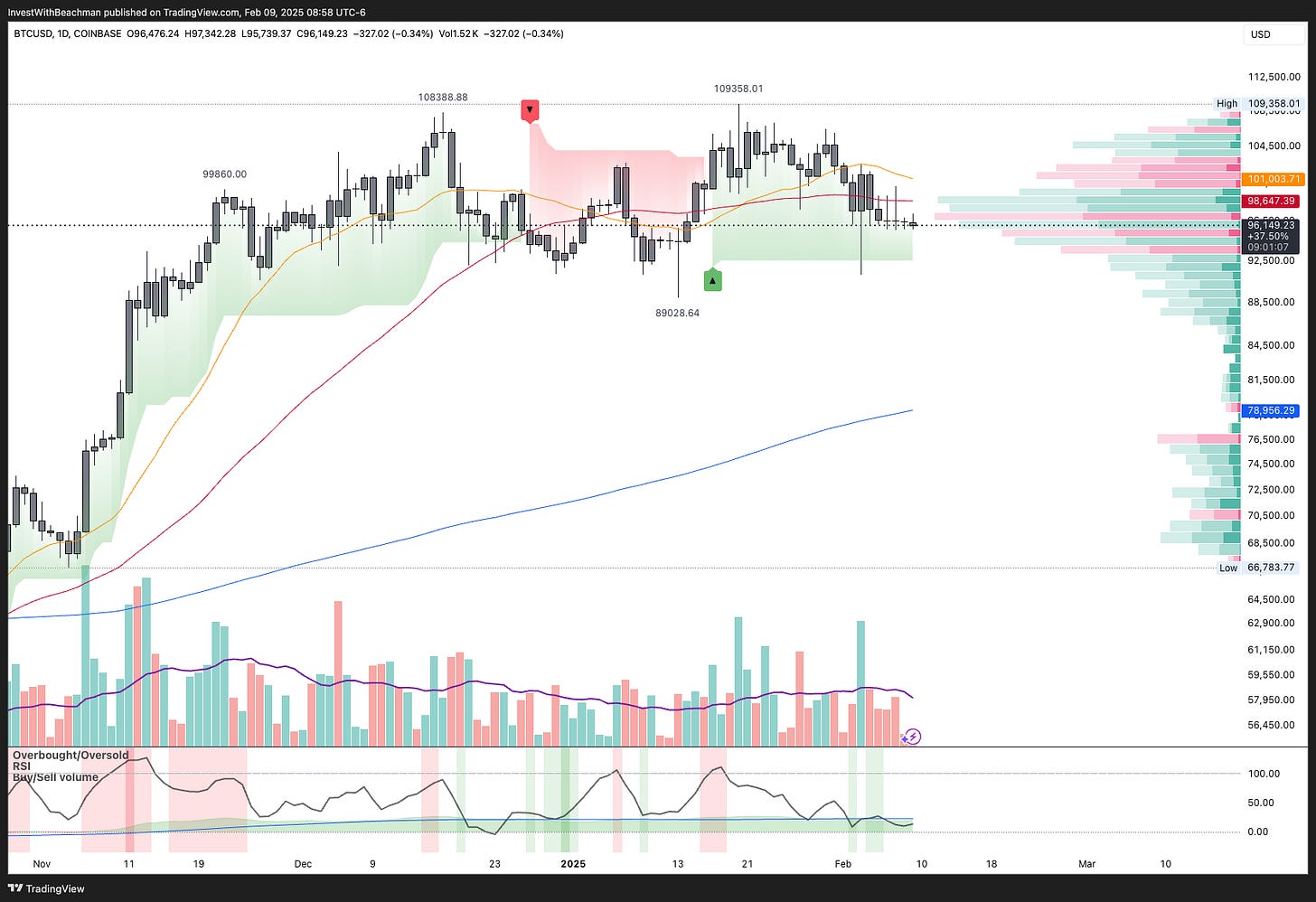

We believe that Bitcoin is in a new base between $90k to $105k. There is still constant buying of this crypto, even while other coins are FOMOed into and out of on wild swings.

What else am I watching?

Copper prices shot up last week…perhaps on the Gaza strip rebuilding plan announcement. This commodity is usually the best tell for where global macro is heading. Lower means macroeconomic pain is ahead and vice versa.

So keep an eye on Dr. Copper.

Bottomline

Markets were tentative all week and more volatile to the downside on Friday. They are still trying to digest everything and pick a direction. Meanwhile, investors got a bit more fearful about inflation, stock prices and crypto…even while they were buying the dip for the past 10 days.

Something is likely to break one way or the other…

At a macro level, the US economy is chugging along with no imminent sign of a recession or economic slowdown. 💪🏽

Cheers.

BEACHMAN,

IF YOU ARE BIDDING ON ALPHA SPYDER CONV.

GOOD LUCK!