Beachman's investing plan - Sold in May? Get your butt back to the markets now!

Portfolio: What I am planning to do in the markets and with my portfolio

That's it folks.

Summer is over as far as the stock market is concerned.

Looking at my portfolio, if I had sold at the end of May and gone away, I would have been relatively flat as of today. I hope your portfolios fared better.

I look forward to this time of the year…Sept…when I get the house back to myself during the day. I can turn down the air-conditioning and I can crank up my playlist on Alexa.

Before we move ahead, a couple of quick announcements:

Starting next week, I will be publishing a series of articles on AI…from an investor point of view. We have learned a ton from this Q2 earnings season about the current state of AI, about the best places to invest now and leading into 2025 and about the so-called AI sectors to avoid. In this series, I will be exploring the overall AI timeline, LLMs, data, memory, storage, enterprise AI, consumer AI, AI on the edge and much more. Each topic will include specific, actionable AI-investing ideas that I am considering. It is time to look past NVDA’s GPUs to find the next set of investment opportunities that could work in 2025.

I am retiring the weekly Market Whispers podcast. It was a fun experiment while it lasted. However, over time I realized that making those audio podcast and YouTube episodes took up a lot of my time and attention away from the core of what this newsletter is about…researching investment opportunities and writing about them. Going forward, this weekly written column (the post you are reading) will take the place of the Market Whispers podcast. I am much more efficient writing about my findings, my ideas and my investing plans. Anyways, the Substack app has an excellent audio-AI-engine that reads posts in a very realistic, human-like voice. Try it out if you have not already done so. My teenager kid could not tell the difference.

Table of contents

Market signals

Key questions

Beachman’s plan

Conclusion

Upcoming exclusive paid content

Join us on the daily chat

If you have not joined us on the chat line here, I highly encourage that you take a few minutes to visit with us. The chat space is reserved exclusively for paid subscribers - interesting questions being asked and answered, growing community engagement and real-time access to Beachman and his portfolio actions during market hours. During volatile market times, chatting with a community of smart investors is especially valuable. Even if you do not feel like contributing, it’s ok to stop by, peruse the dialogue and get a feel for the sentiment among the Beachman community.

If you are new here, please check out the must-reads listed on the About page and the Roadmap page. Also follow Beachman on:

Twitter @Iwannabeontheb2

Market signals

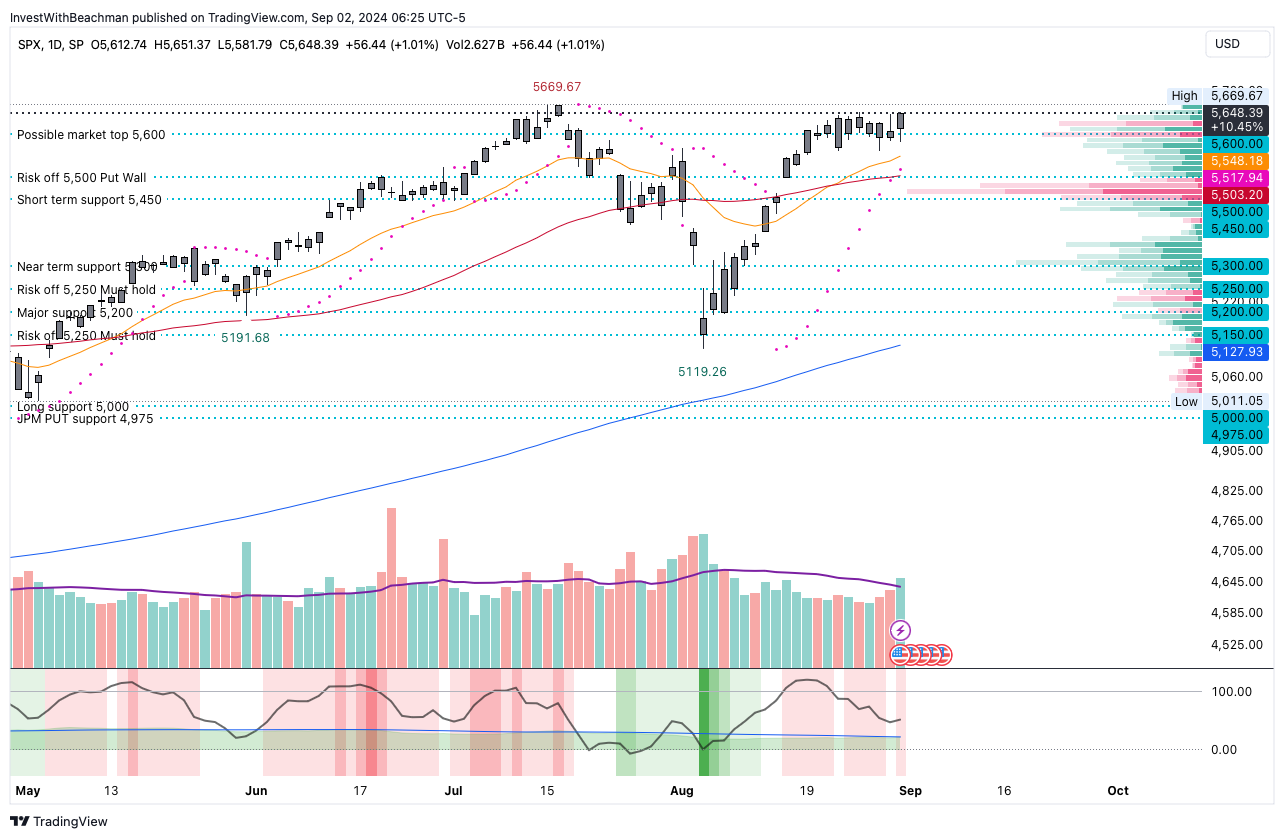

The last few weeks have been relatively quiet on Wall Street, based on trading volume (daily volume bars lower than the purple moving average on the chart below), as we headed into Aug month-end and the long US Labor Day weekend.

The index continues to push up against the 5,600 resistance level. Barring the Aug 5th Japan carry trade scare, it remains overbought and overvalued (all the red shading on the bottom section of the chart).

There is good support available at 5,450, at 5,300, at 5,200 and even at 5,000 (which would be a -10% correction level). Given the highly telegraphed first rate cut in a few weeks, I expect dips to be bought.

However, things could get more interesting, more complicated in Sept.

Sept is not a good month for stocks

Looking at data going back as far at 1928, Sept has been historically one of the…if not the worst months for stocks. See the graph below.

Additionally, 2024 is an election year during which market volatility typically climbs higher each month leading into Nov.

Looking at the market calendar, we have a large monthly options expiry on Sept 20th and another large quarterly options expiry on Sept 30th. Those timeframes could be a bit more chaotic, especially the week of the 20th which is a triple witching expiry, involving stocks, indexes and currencies. Oh btw, the US Feds are also meeting that week to decide on interest rates…LOL.

PCE inflation, the US Feds favorite marker

Last week we received yet another lower trending inflation report, this time the PCE inflation for July. Suffice to say, these readings continue to be stuck in the 2-3% range…subdued and heading further South.

The big surprise was a fairly bullish Q2 GDP growth estimate of 3.0% after we had 1.4% in Q1 and with Q3 now estimated at around 2.5%. Apparently, consumer spending was stronger than expected last quarter.

With so many conflicting macro signals these days…I must confess that I am nonplussed. When that happens, I usually refer back to what the macro whisperer,

says about the economy in his wonderful substack, Stay Vigilant. Richard reminds us to dig deeper behind the headline number and look at overall productivity trends. It is not as pretty as it seems.NVDA, it’s in the eye of the beholder

NVDA did not, technically, disappoint with their Q2 earnings report, however the stock price did not jump higher as it has done in the past. Some investors were happy with the report, while others were disappointed. Traders used it as an opportunity to press their respective long or short positions. Everybody’s personal opinion or thesis was validated by something they saw in the report…

Furthermore, as per these charts from TheDailyShot, retail investors are highly involved with NVDA stock, directly or via leveraged ETFs. Lots of skin in the game…

I won’t extrapolate further on NVDA here because I have a more detailed post coming out tomorrow. Suffice to say, my game plan for my overweight position is now better informed.

Key questions

The specific, top-of-mind questions that will shape where and how I invest for the rest of 2024 and leading into 2025:

Who is actually making money in AI now or in the near future?

When will the current AI capex boom turn lower?

Who will be the next beneficiary of hyperscaler and enterprise AI spend?

Are markets underestimating US geopolitical risk?

I am a growth investor, a tech investor. Right now, AI and cybersecurity are the two hottest investing themes with multiple catalysts in play. Therefore, no surprise that most of the questions above are AI-related. I curate such research questions to stay hyper focused on finding the best investment opportunities for my portfolio.

I, currently, have 5 stocks and 2 ETFs on my active watchlist. 2 of these stocks recently confirmed their AI-investing thesis and I identified preferred buy points for them. The 2 ETFs are interest rate sensitive plays and I am waiting for appropriate entry points in them too.

The hunt continues…

Beachman’s plan

Given the market signals that I discussed last week and above…

…given the key questions that I am researching…

…my simple, actionable, measurable investing plan is as follows: