I am back from a wonderful vacation in Portugal. Lovely place. Friendly people. Amazing wine. Meh food, imho.

My personal ratings (with no intention of offending anyone, btw): France has the most beautiful architecture. Spain has the best wine and vibe. UK has the tastiest international cuisine (not British food). Greece and Italy, both, have unmatched, awe-inspiring history. Everything else in Europe is kinda ok. But, I am not complaining. The entire continent is worth visiting, every nation has cool, interesting stuff to experience and the US $ goes a long way over there.

While I was away, the SP500 kept grinding higher…added +5% and got close to its YTD high and ATH. It added about $4T in market cap in about two weeks, since the Aug 5th low. The Nasdaq100 did something similar, adding almost +7% to its tally.

Markets seem have quickly forgotten and recovered from the carry trade and recession worries of early Aug. A few readers told me to go back across the pond…apparently that seems to keep stocks higher…will do sir! 🫡 🛫

As I read and catch up on my holdings and stocks of interest, the one question that I am trying to answer is…

Is it time to buy?

With about a 30% cash allocation at hand, where and how I invest over the next few months will have strong implications for my 2024 and 2025 investing performance.

Market signals

As always, let’s do a pulse check on markets by taking a closer look at the charts and metrics.

SP500

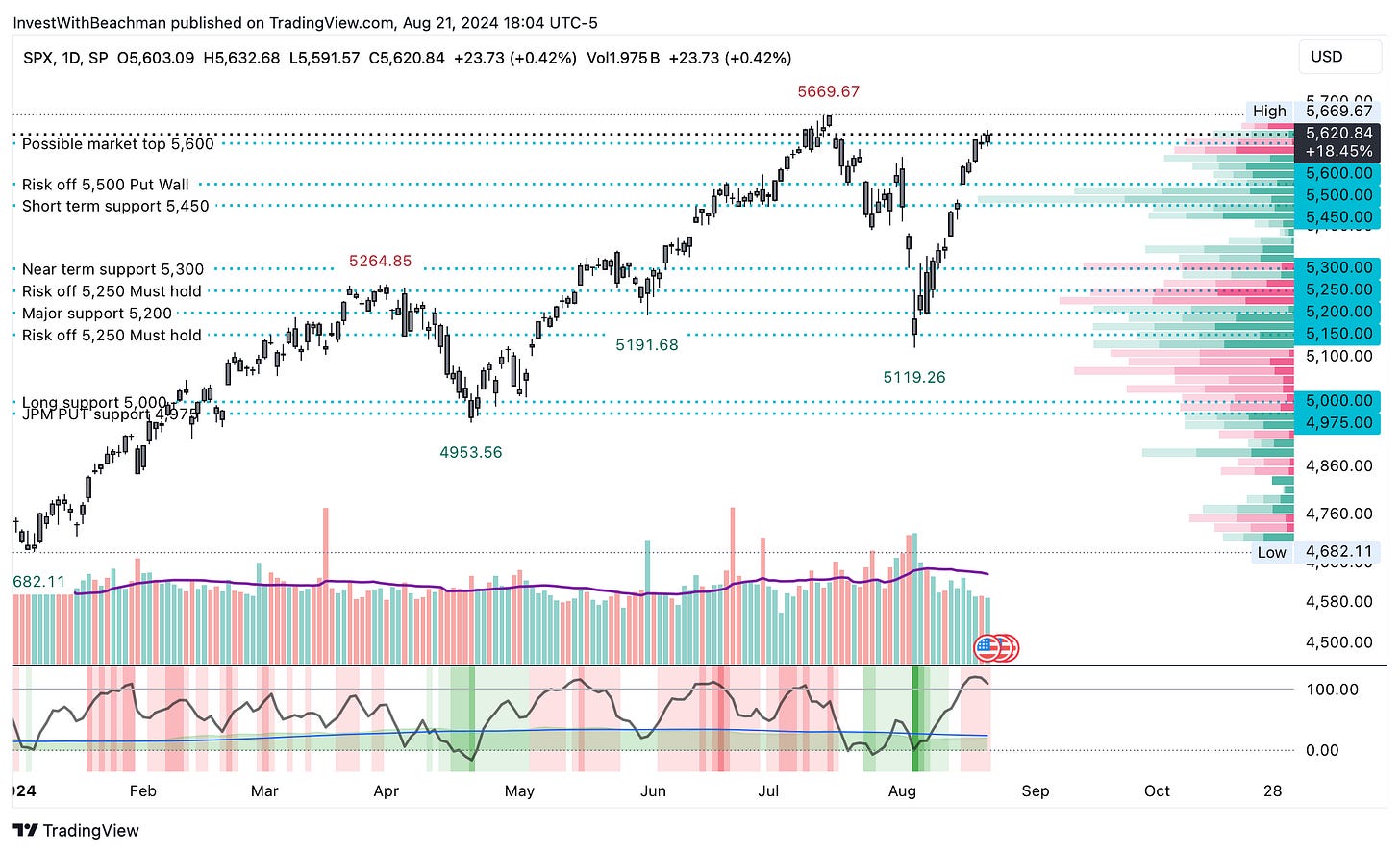

Over the past 2 weeks, the SP500 kept moving higher on consecutively lower trading volume. This index is now well into overbought territory and sniffing out a possible market top. There are more sellers than buyers today…more profit taking. In fact, as per Marketwatch, retail and insiders seem to be buying in while institutions are taking money out of equities.

Nasdaq100

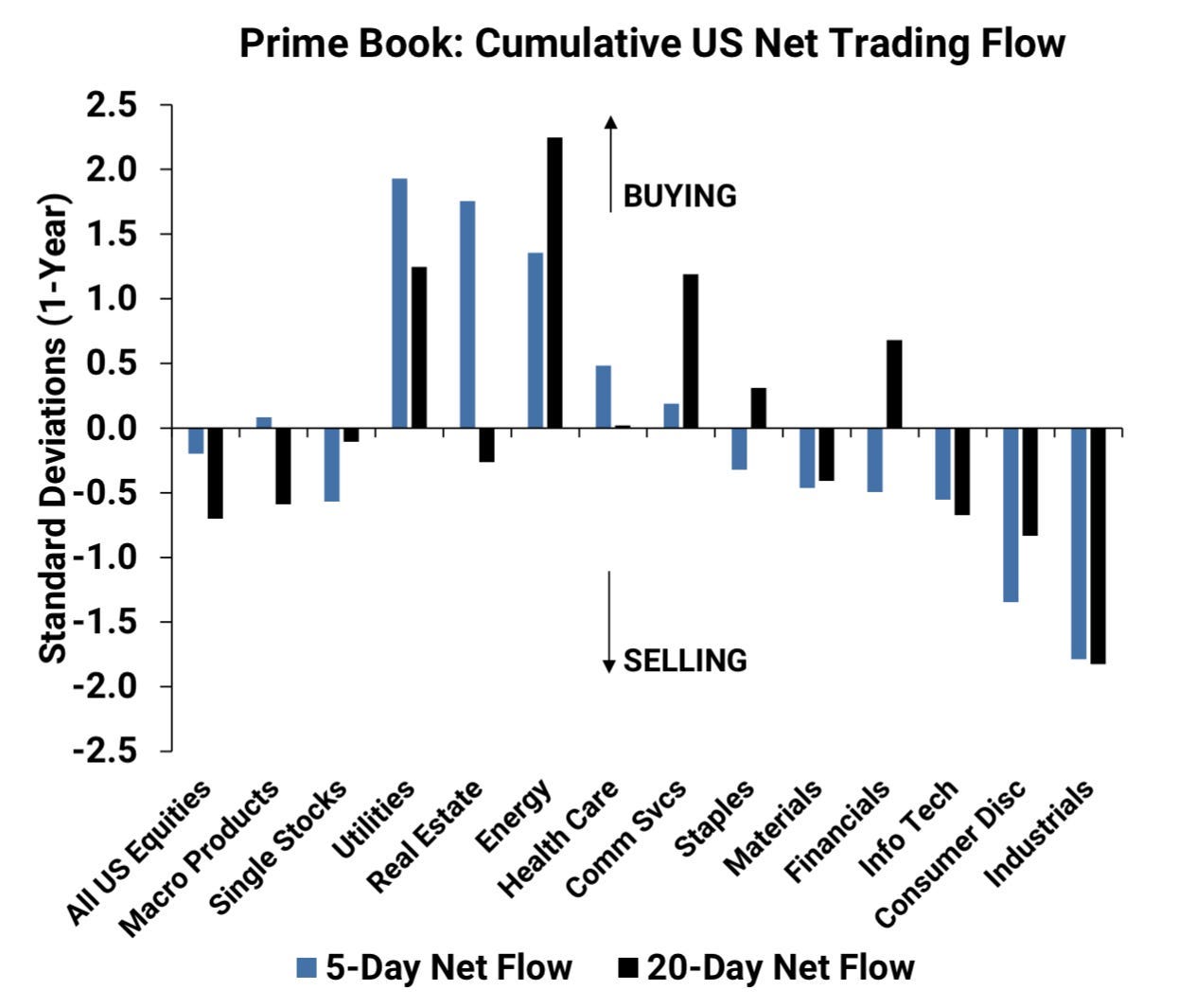

The NDX shows similar technicals, even though it is about 4% away from its ATH…lower trading volume, declining buying versus selling and overbought valuations. Here too, as per GS, institutions have been selling tech stocks to log gains and buying other sectors.

Megacaps

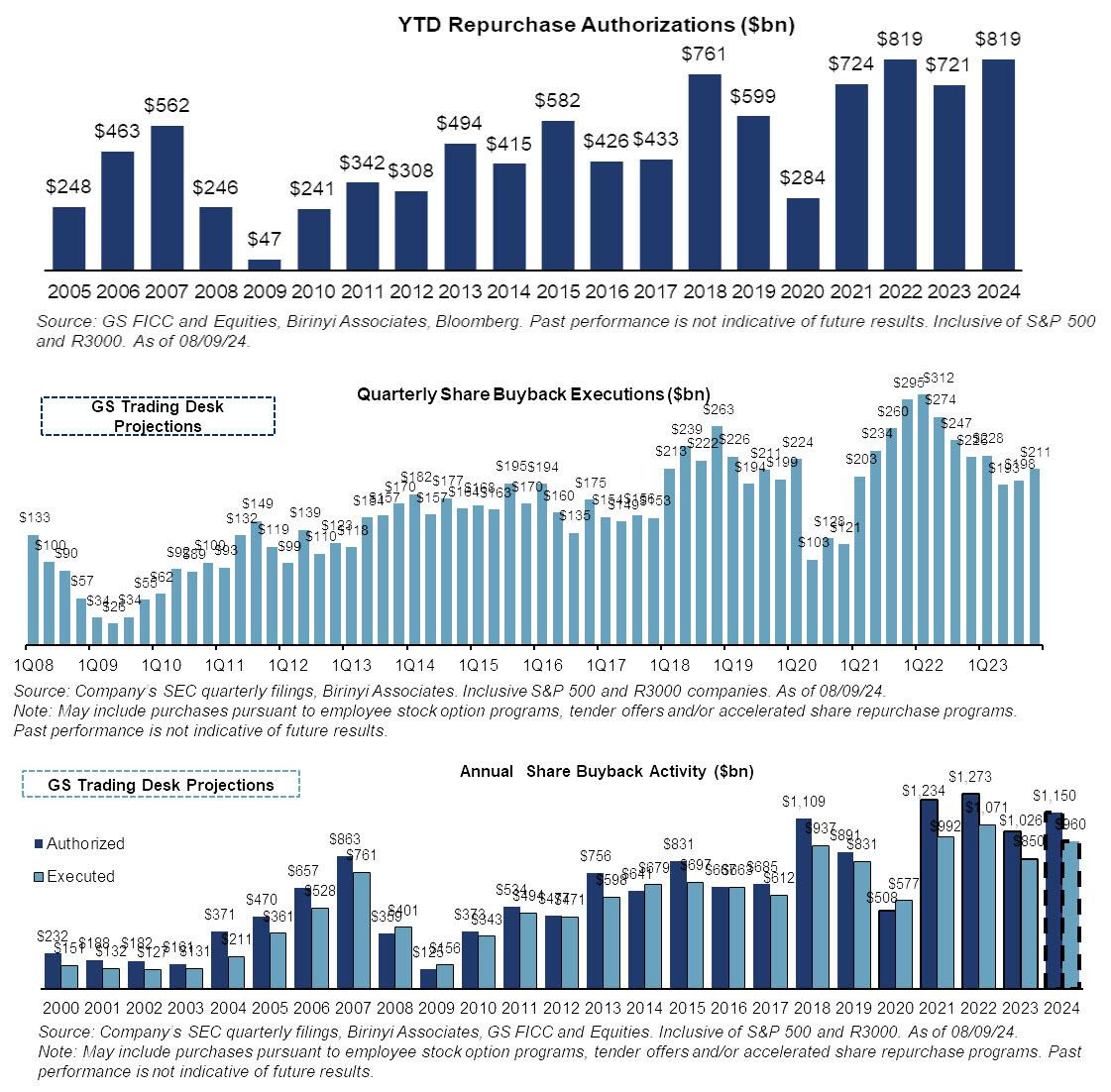

All the mega caps stocks, except GOOG, are overbought today. They are sporting similar technicals as the SP500 and the NDX above…not surprising because they collectively represent between 35-40% of these indexes by market cap. These cash-rich companies are now out of the earnings blackout period and are freely repurchasing their shares in the open market. See more below.

Macro

Macro continues to throw up confusing and contradictory signals while certain collective trends are undeniably clear:

Inflation: is clearly in a down trend. Recent retail (CPI) and wholesale (PPI) inflation readings continue to take us closer to the Feds’ 2% target, while being range-bound between 2 - 4% depending on which measure you look at.

Unemployment: is rising. The Sahm rule indicator triggered last month and is being hotly debated. Layoffs are more in the news while hiring is being tempered. Jobless claims are also trending higher. The US jobs market is still healthy, but sharpening its pencil.

Consumer spending: is narrowing in focus. Big ticket and discretionary spending is being put on the back burner, while staples and value bargains are sought at discount retailers like Walmart and Target.

Earnings: have largely been in line with expectations and overall a disappointment. 79% of SP500 companies have reported Q2 earnings beats, but by only about 3.5%, which is less than half the long term averages. Meaning these companies are just performing to expectations with no real upside surprise…even when their management teams play the guidance game with WS analysts. Looking ahead, Q3 is expected to be slightly better and Q4 is slated to be much higher…let’s see what happens.

ST interest rates: The US Feds are more ready to make a rate cut in Sept (per recently released meeting minutes). Markets are pricing in a 0.50% rate cut next month…this is one of the overvaluation signals, imo. I think we will get a 0.25% cut and more dovish messaging in Sept.

US$ and LT rates: The US$ (DXY) is trending lower along with long term interest rates. This is usually good for US exports and good for international markets. However, if these trends continue, they tie back to higher import prices, the higher unemployment rate, the more careful consumer and a possible economic slowdown in the future.

Commodities: are all staying depressed…oil, gas, materials…all of them are waiting for signals of higher demand that don’t seem to be coming from anywhere in the world!

Share buybacks: As per GS, 2024 will see about $1.15T in share repurchases by year end. 80% of this approved volume has already been executed.

Black swans in the making

By definition, since we are anticipating these troubles, they don’t classify as black swans. However, the point is that there are a few geopolitical developments that could suddenly take markets south. We need to keep an eye on them.

Middle eastern conflict: If Iran initiates a major military strike, it could send a shudder through oil markets, interest rates, currencies, commodities and equities. So far, they seem to be demonstrating restraint.

Carry trade: As per GS, the Japanese Yen based carry trade is back. About 50% of the trade volume has been put back in place. If the BOJ says anything about interest rate hikes, all hell could break loose in global markets again. Btw, the Mexican peso could also face a similar carry trade meltdown. Keep an eye on the peso and that country’s stock market.

Ukraine war: has unfortunately been slowly and steadily moved off the front page. Markets don’t seem to care about it.

Misleading signals

While there are some “good” leading macro indicators that can help us as investors, there are also some misleading lagging indicators that we should be wary of:

13-F filings: I mostly ignore any post, tweet or article about which legendary investor bought which stock as per their most recent 13-F filing. This is always old news and does not likely reflect the current state of their respective portfolios. We should remember that 13-Fs are filed 45 days after each quarter and by the time they are revealed, the portfolio holdings could be vastly different from what we think they are. Buying ULTA now because Buffet bought it in Q2…buying NKE now because Ackman bought it in June….all that does not sound too interesting to me.

Soft landing or hard landing: Who cares? I invest in tech stocks. I stay away from consumer dependent stocks like CELH, ELF, NKE, DIS, ABNB etc. Let the pundits argue and debate and waste saliva on the question. For my investing purposes, a soft landing would be nice, however a hard landing is not a run-for-the-hills situation.

Beachman’s investing plan

And so I come back to my original question…

Is it time to buy?

My simple, actionable, measurable investing plan is as follows: