State of the markets - Nov 7th 2022

Musings: What I am watching and doing in the markets this week

Before we get into the discussion about the markets, if you have not already done so, join the Beachman’s live chat on the Substack app.

Download the app by clicking this link. Chat is only on iOS for now, but chat is coming to the Android app soon. Open the app and tap the Chat icon. It looks like two bubbles in the bottom bar, and you’ll see a row for my chat inside.

That’s it! Jump into my thread to say hi, and if you have any issues, check out Substack’s FAQ.

Current state

The SP 500 traded in a wide range on Friday last week but ended up when buyers pushed just 4 points above its open. See the green candlestick on the chart above. The SP500 and the Nasdaq held their Oct lows. Investors want to get into this market at these “discount” prices. The index dropped below all it’s moving averages on Thu but regained its 21day EMA by close on Friday.

The upward RSI trend remains intact for now.

The MACD oscillator indicator is also staying in the green…for now.

Sentiment

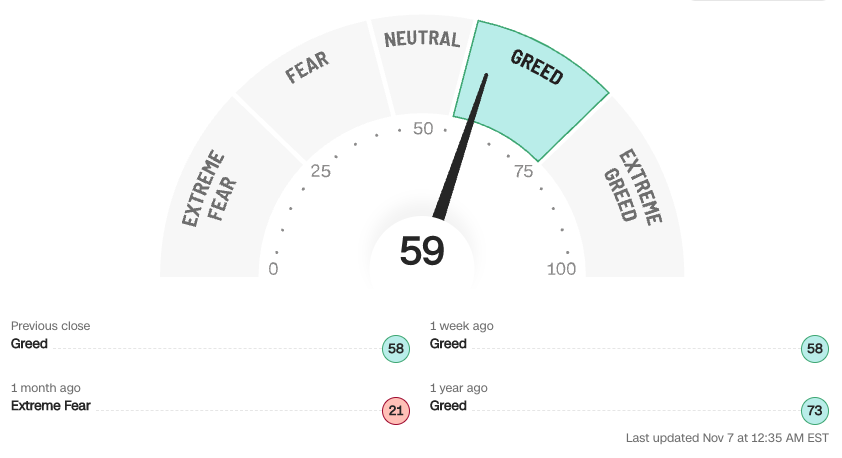

Even though many growth and tech stocks swooned into deep red territory late last week, overall investor sentiment is pretty bullish. The Fear and Greed index briefly turned Neutral on Friday before swinging back into Greed territory.

The current total Put to Call ratio is 1.07 which is pretty close to neutral meaning about equal number of bearish versus bullish options bets being placed.

Other indicators

The VIX volatility index closed down for 15 straight days. This is one of the best bullish signs imo.

US $DXY dropped about 3% last week and is currently basing around the 55day EMA.

Oil prices rose last week between 3-5% in the hopes of a China re-opening. These hopes were dashed over the weekend and oil prices dropped lower by about 1-2% since then.

Copper prices also did a similar China-related headfake, going up last week and them coming back down over the weekend.

Natural gas prices jumped 7% over the weekend. I am not sure why and I need to research this.

Last week

All eyes were on the US Fed Nov meeting (more below) and what they would say, do and signal, without saying or doing.

A few key learnings from the week floated to the top of my notes:

The FOMC raised interest rates by 0.75% as expected and more importantly, signalled that:

They are looking at both lagging data and forward looking data while making rate decisions.

There is a path to a soft recessionary landing but it is a narrower path.

They are still focused on fighting inflation and this battle is not over.

Labor market strength is extending inflationary pressures.

We could have a longer shallow recession in 2023.

They will pay close attention to ensure that they do not overtighten economic conditions and cause a deep recession.

Wall Street pundits are suggesting that Powell is maintaining his hawkish tone to ensure that markets do not get into a bullish frenzy expecting an interest rate pivot soon.

Some experts are even reading the tea leaves to mean that the pause in rate hikes is closer than we think.

Bond markets pointed to a possible incoming recession. 10yr and 30yr bond rates were lower than shorter term 2yr and 5yr rates. This is called an inverted yield curve. Lower rates for the longer term bonds could be signalling that in the future, if there is a recession, the FOMC will have to reduce interest rates to counter the economic slowdown.

We received a lot of jobs and employment related updates:

October jobs growth was 261,000 jobs versus 205,000 expected.

JOLTS reported that job vacancies climbed to 10.7M in September from a upwards revised 10.3M in August. Both these numbers were higher than expected.

ADP payrolls report topped estimates by +22%, with private businesses creating 239,000 new jobs in October, versus 195,000 expected.

Several companies announced layoffs or hiring pauses - LYFT, AAPL, AMZN, META, MSFT, INTC, QCOM, Stripe, TWTR

Manufacturing has stagnated with the ISM at 50.2, it’s lowest reading since May 2020.

ISM prices (whole sale goods and commodities prices) fell to their lowest levels since March 2009

Chinese stocks initially rose on rumours that China is making plans to gradually exit its strict Covid Zero policy. China's health agency dismissed these rumors as not true and Chinese stocks fell back down. Investors need to be wary of the pump-and-dump scheme. In reality, China ordered a 7-day lockdown of iPhone City (Foxconn’s main plant in Zhengzhou).

US auto inventory hit an 18-month high with 32 days supply vs 23 days at this time last year. Auto-related supply chains are easing up and retail prices for used cars are also following suit.

We received Q3 earnings reports from several companies and these are a few that stood out to me:

AIG, PRU - insurance companies are beating EPS expectations

ABNB - travel is still strong

CFLT - continues to execute to its roadmap

CVNA - auto sales are slowing down significantly

DASH - surprise upbeat report; people still spending on food delivery

DDOG - strong growth, no competition

DKNG - also seeing slowdown but planning to partner with ESPN/Disney on sports gambling

HUM, CI - strong earnings and forecast for health insurers

Maersk - shipping volume and rates are coming down

PTON - broken business model, bleeding cash, slow turnaround

QCOM - still pivoting from mobile to next gen auto

ROKU - losing the battle for connected TV ad spend in this environment

SBUX - still healthy retail sales and expecting resurgence after possible China reopening

TWLO - same macro impact story leading to BoA downgrade and mgmt pulled the 30% growth target from 2023 expectations

ZI - forward growth being impacted by macro conditions

Interesting cloud Q3 earnings info from Jamin Ball: So far we’ve had ~30 cloud software companies report Q3. The median Q3 beat: 2.5%. Median Q4 guidance raise: 0.0% (50% guided above consensus, 50% guided below consensus). These numbers have been dropping since Q4 2021.

Mortgage demand was basically flat last week, but refinancing down 85%yoy. Zillow said transaction volume down 40%yoy in $ terms due to macro factors.

Key market events

Mon Nov 7th - Earnings PLTR

Tue Nov 8th - U.S. mid-term elections, Earnings AFRM, DIS, UPST

Wed Nov 9th - Earnings BYND, RBLX, TTD, U

Thu Nov 10th - US CPI report for Oct, Earnings DOCS

Risks

All eyes on the Oct CPI report coming out on Thu. Markets will likely stay subdued until we get those numbers. A high CPI read will depress markets further and vice versa.

Any major elections is always a time for caution in the event of a surprise political event. This week’s US mid term elections is no exception. Markets will swing up or down on Wed depending on the outcome of the votes.

Beachman’s plan

Here is what I plan to do with my portfolio…

Paid subscribers can read on.

If you are a free subscriber, consider upgrading to a paid subscription to read about my specific portfolio actions and my current holdings. You will also receive my stock picks, buys and sells, actionable market & earnings analysis and other equity and crypto due diligence.