State of the markets - Nov 28th 2022

Markets: What I am watching and doing in the markets this week

Last call

This is a final reminder that our prices will increase in three days, on Dec 1st 2022. Here is your opportunity to lock in the very reasonable, founding year rates for the life of your paid subscription. See more details here.

Also, I am continuing to post intra-day updates and information in the chat on the Substack app. Join the discussion here.

Current state

This market and this economy is currently full of contradictory signs. For the past 6-8 weeks, we have been getting encouraging data that the economy is strong, that supply chains are easing, that the consumer is doing ok, that businesses, including small and medium sized companies, are thriving, that inflation is coming down, that energy and gas prices are in check, that job growth is healthy. And then there are negative signals too, that inflation is still too high, that consumer savings are down, that debt levels are rising and defaults are picking up, that energy production is slowing down, that jobless claims are increasing, that mortgage rates have doubled, that COVID is still raging in some parts of the world.

This is quite normal for this time in an economy’s lifecycle, when it is transitioning from a fast-paced, all-is-hunky-dory situation to a time-to-hit-the-brakes-on-everything slowdown (aka recession) as we digest a series of back-to-back, large interest rate hikes.

The challenge for us, investors, is not to focus on just a few signals instead of considering the entire economic picture. To not get caught up in any metric biases that might color our understanding and lead to hasty decisions. To better understand the nature of market and economic cycles, to realize that we are all human and to layer on top a healthy dose of typical common sense.

The SP 500 closed barely 0.15% higher for the Thanksgiving holiday week ending Nov 25th. But the primary, bullish technicals remain in place, including closing above several moving averages with a rising RSI and an increasing MACD oscillator.

The underlying health of the market continues to improve as seen in the chart below. This data from Barchart shows an increasing number of stocks above their long term and short term moving averages from last month to last week leading up to today.

Sentiment

The Fear and Greed index is also more firmly planted in the Greed section, getting back above last year’s levels at this time. Remember how bullish we were then? Seems like ages ago.

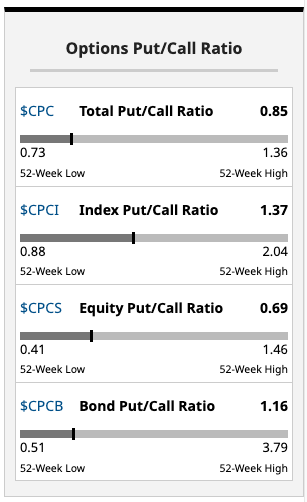

We can also see this investor bullishness reflected in the Put to Call ratios above. More calls being bought versus puts, except for the market indexes. Investors expect individual stocks to climb higher, while preparing for some short term weakness in the Dow Jones and SP 500 indexes specifically.

Other indicators

US $DXY - Same old, same old, stuck in a $105-107 range and below its moving averages. US$ bears are getting louder these days.

Oil - U.S. oil prices fell below $80 a barrel last week, to their lowest levels since September, as the prognosis for the global economy grew gloomier. Falling prices indicate weaker global demand and greater recessionary concerns. The latest indication that demand for oil is waning comes from a carefully watched indicator of Asian crude consumption, which fell to a seven-month low. Meanwhile diesel prices are still high with stockpiles at record lows.

Last week

A few key learnings from last week floated to the top of my notes:

US FOMC - Nov meeting minutes confirmed that there was “substantial” discussion about smaller rate hikes going forward. We still do not know where and when rate hikes will end, however we seemed to have turned the corner a little bit, which bodes well for growth investors.

Disney - brought back their previous CEO, Bob Iger, in somewhat of an overnight coup led by the board of directors. Bob has now been charged with righting the ship and he has a two year term to do so.

Inflation - The Conference Board’s Leading Economic Indicators index has fallen for 8 consecutive months showing a worsening consumer outlook and weakening demand for manufactured goods and housing. According to BofA: More than 90% of money managers expect stagflation in 2023. Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation.

Manufacturing - The Chicago Fed National Activity Index, that measures overall economic activity and inflationary pressures, decreased from +0.17 in Sept to -0.05 in Oct. Nov services purchasing managers index (PMI) was 46.1 vs. 47.9 expected. Manufacturing PMI for Nov was 47.6 vs. 50.0 estimated. All these metrics show that U.S. economic activity is slowing. We should note that manufacturing represents only 10% of the US economy.

Earnings - Over 95% of S&P 500 companies have reported their Q3 2022 earnings. Overall EPS growth so far has been about 2.2%, which is the lowest growth since the start of the pandemic.

ADSK - weaker than expected forward guidance due to macro headwinds

BBY - surprisingly better-than-expected quarter and a hopeful Q4 forecast

DE - beat estimates and raised its forward guidance

DELL - confirmed lower desktop sales similar to what other desktop semiconductor companies have reported recently

ZM - another dismal earnings report. A 5% growth rate is not going to cut it with investors that want to see a revamped product roadmap

VMW - higher revenue, lower earnings

Labor - HP was the latest tech company to announce that they will be laying off 10% of their headcount. Jobless claims for the week rose to 240,000, above the 225,000 economists expected, signaling that the labor market may be weakening.

Real estate - Surprisingly, Oct new home sales were 632,000, much higher than the 570,000 estimate.

Crypto - Fallout of the FTX implosion continues with more revelations of spending excesses and flagrant disregard for normal business practices. Question that is making the rounds: Is GBTC the next domino to fall? GBTC refused to share proof of BTC reserves due to “security concerns”. Shares of GBTC are trading at deep discount of around 50%. Cathie Wood is still sticking to her $1 million price target for Bitcoin by 2030….in her words, "Bitcoin will come out of crisis smelling like a rose".

Consumers - Excess savings reached a peak estimate of $2.3T in 2021 and helped consumers tolerate inflation. That metric is now projected to be $1.2-1.7T giving households a cushion of 9 to 12 months. The rate of savings has decreased from 16.8% in 2020 to 11.8% in 2021 and now to 3.1% in Q3 2022. The UofMichigan Consumer Sentiment metric came in better at 56.7 vs. 55 estimated.

COVID - Covid cases continue to rise in China, leading to more lockdowns, increasing restrictions and now widening protests. Activity in China's capital of Beijing is grinding to a halt. Lockdowns are currently affecting about 20% of China’s total economic output.

Soccer - The 2022 World cup soccer tournament kicked off in Qatar. Soccer is the most popular global sport with over 240M registered players and over 3.5B fans from more than 200 countries. The sport of soccer is valued at about $600B in terms of commercial value. including team values, player salaries, sponsorships, broadcast rights, merchandise sales etc.

United Kingdom - is having second thoughts about Brexit. Only Russia is suffering a bigger economic contraction (than the U.K.) in 2022 among the G-20 leading developed and developing economies. 56% of the population said Britain was “wrong” to vote to leave the EU in 2016, compared to 32% who said it was the right call. U.K. trade as a percentage of GDP has fallen from around 63% in 2019 to around 55% in 2021.

Key market events

Mon 11/28 - ?

Tue 11/29 - Consumer confidence index report, Home prices index reports, Earnings CRWD, HPE, INTC

Wed 11/30 - Chicago PMI report, Job openings & quit reports, Chair Powell speech, Earnings CRM, ESTC, OKTA, RY, SNOW, SPLK

Thu 12/1 - Jobless claims reports, PCE price index reports, ISM report, Earnings ASAN, MRVL, PATH, ZS

Fri 12/2 - US Labor Dept.’s jobs & unemployment reports

Risks

We should continue to be aware of the risk of year-end tax loss selling, especially for any positions that have dropped significantly this year. Investors tend to sell those stocks into any price rise of note.

Beachman’s plan

Here is what I plan to do with my portfolio…

Paid subscribers can read on.

If you are a free subscriber, consider upgrading to a paid subscription to read about my specific portfolio actions and my current holdings. You will also receive my stock picks, buys and sells, actionable market & earnings analysis and other equity and crypto due diligence.