State of the markets - Nov 21st 2022

Markets: What I am watching and doing in the markets this week

First off, I am taking a break from Twitter and commiting myself to using the Substack chat app more consistently to post market updates and engage in frequent, investing related discussions. You can find me on the chat line here.

Don't expect too much from the markets this week. They are open M T W, closed for Thu Thanksgiving and open half-day on Black Friday. So instead of the regular 5x 6.5 hours in a week, we will only have 3.5x 6.5hours of trading and almost half of that will be with lower than average volume.

This note from JPM's Ron Adler explains current market mood well.

"SPX volumes are -25%. More importantly, buyers have difficulty finding comfort at current valuations while earnings fears for next year continue to propagate while sellers wanting to sell near unnatural levels from last week’s squeeze..."

I have started gathering and mapping out 2023 forecasts across about 40 macro metrics. I plan to publish the comprehensive 2023 roadmap before year end, including sector-specific trends.

Current state

The SP500 is trying to hold above all the moving averages that I track. See the chart below.

In my book, this continues to be a market that wants to rise...or at least a market that does not want to go lower. I am particularly heartened by the RSI (see blue line above) that has been in an upward trend since end-Sept.

Sentiment

The F&G index is staying "greedy"...ahem "healthy". As long as it stays close to the neutral and leans towards the right side, that is good for bullish market action. Once it gets to either of the extreme corners, we tend to get into trouble one way or the other.

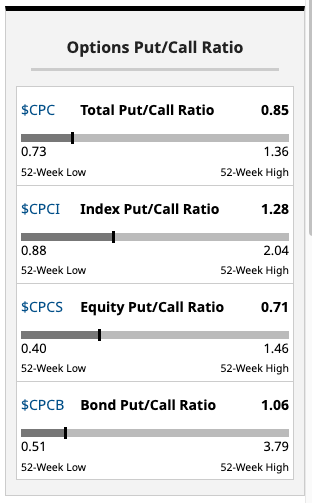

Call to Put ratio

Interesting divergence above because investors are less bearish on equities (PC ratio is lower than 1) yet believe that the index has further to fall (PC ratio more than 1). This could be a sign that investors like me are getting more picky, as they should, about the stocks that they own. e.g. If we are heading into a recession in 2023 or if we are already in a mild one, then which sectors and stocks do I want to own in such a macro environment?

Other indicators

US $DXY is at 3-month lows and seems to be stuck below its 150d moving average.

Oil continues to stay range bound ($80-90) where we like it. US Energy Information Administration reported that several inventory measures are down by 5-15% from their historical 5-year averages, including commercial crude oil stockpiles, gasoline inventories, distillate inventories. Refineries are operating at 93% capacity. Diesel fuel, used in farm equipment, shipping and manufacturing, has gained in price by about 50% this year, far more than the rise in regular gasoline. Demand is normalizing and prices at the pump are coming down...I have stopped checking while I drive by...which means that I am not worried about filling up my gas tank.

Natural gas prices and inventories are back to typical levels, the Energy Information Administration said last week, easing concerns about availability this winter. This is a good sign for Europe and the US that are some of the world's largest consumers of this resource.

Last week

A few key learnings from last week floated to the top of my notes:

U.S. producer price index (PPI) rose 0.2% in Oct, below the 0.4%est. PPI rose 8%yoy compared to the 8.3%est and 8.4% in Sept. Ex-food and energy, the actual was 6.7%yoy vs. 7.2%est. And we saw a small but encouraging 0.1% decline in services for the first time since Nov 2020.

Manufacturing is giving us confusing readings. NY Empire State Manufacturing Survey for November registered a 4.5% reading, much better than the -6%est. It was -9.1% last month. Philadelphia Fed factory activity index however dropped unexpectedly.

Earnings

CSCO - beat expectations and raised outlook; supply chain improving

DLO - hit by short report inspite of revenue growth, beating expectations and expansion in Asia and Africa

HD - in-line with expectations on revenues and earnings; used more by professionals

LOW - beat expectations and raised guidance; used more by DIYs; consumer home improvement spend is still strong, especially 250k new Millennial home owners

MNDY - still growing strongly, healthy large cust growth and expanding margins

NVDA - reported in line with lower expectations; datacenter chugging, auto strong, gaming weak

SEA - still bleeding cash and profitable segments subsidizing non-profitable stuff

TGT - margins sinking; forecasting poor Q4 holidays sales quarter; further cost cuts coming; says shoplifting is up 50%yoy

WMT - beat expectations and raised outlook; inventory glut is quickly being addressed; $20B buyback program

Labor - Contradictory signs here too, although continues to show strength in terms of jobs and labor rates. Initial jobless claims were down 4k to 222,000 in previous week. Meanwhile layoffs continue, especially in tech with AMZN announcing 10k job cuts.

Real estate - Housing starts were weaker at -4.2% vs. -2%est. Mortgage rates saw the biggest weekly decline in 41 years, with the 30yr fixed mortgage falling to 6.61% from 7.08% last week. Rates are staying elevated because banks, the US Feds, foreign buyers and fund managers have slowed their purchases of mortgage bonds. The lack of buyers for these bonds, keeps their market prices lower and pushes their rates higher.

US elections - Dems retain the Senate. GOP wins the House. Divided Congress for next two years means no major new regulations will likely get passed. This is good for the markets. Everything else is just noise.

Crypto - The fallout from the FTX collapse continues. I don't think we have seen the last of the bankruptcies and bailouts. Many expecting a delay in institutional adoption until regulations are in place. I suspect that Govt. issued CBDCs will come out soon followed by some light regulations to start with. I, myself, have some funds stuck in the Genesis withdrawal halt...1-2 vacation trips worth. My focus has always been on the picks and shovels technolgies and not the get-rich-quickly schemes.

Consumers - US retail sales are up 8.3%yoy. US households accumulated $351B in debt last quarter, putting total debt at $16.5T which is 8.3%yoy (biggest jump since 2008). Credit card balances surged by 15%, the most in over 20 years as consumers borrow more to keep up with rising prices. The increased credit card usage comes despite the highest interest rates, at 19%, charged by lenders going back to the mid-80s.

Key market events

Mon 11/21 - Earnings DELL, ZM

Tue 11/22 - Earnings BBY, DLTR

Wed 11/23 - Earnings DE, durable goods orders Oct, new home sales Oct

Thu 11/24 - US markets closed

Fri 11/25 - Us markets open for 1/2 day

Risks

Next week, we should start seeing an elevated level of tax-loss selling. The selling this year is going to be particularly high in volume, given how many growth and tech stocks have been decimated. Any rallies in the remaining 5 weeks of the year will likely be sold into.

Markets will also be moved by analyst rating changes. Now that earnings season is mostly over, analysts are re-forecasting revenues and earnings for the stocks that they follow, leading to a flood of ratings changes over the next few weeks. I pay more attention to the underlying reasons for the rating change, than the rating itself.

Beachman’s plan

So here is what I plan to do with my portfolio this week…

Paid subscribers can read on.

If you are a free subscriber, consider upgrading to a paid subscription to read about my specific portfolio actions and my current holdings. You will also receive my stock picks, buys and sells, actionable market & earnings analysis and other equity and crypto due diligence.