Beachman's investing plan - Taking names, cleaning shop, making bigger bets and going hunting

Portfolio: What I am planning to do in the markets and with my portfolio

This is the Beachman pivot plan in action.

I started plotting this plan in May and have been executing it steadily over the past three months. This is what I said I would do. Trim or cut stocks that don’t meet my criteria any more. Look for stocks that I am comfortable holding through market volatility….stocks with strong, improving fundamentals and better forward business prospects. Now, I am hunting for other stocks with an eye towards 2025.

Table of contents

Market signals

Beachman’s plan

Why I closed these two positions?

What about Crowdstrike CRWD?

Conclusion

Upcoming exclusive paid content

Financial maps

Join us on the daily chat

I continue to hear from paid subscribers that our chat line is one of the most useful features of my substack.

If you have not joined us on the chat line here, I highly encourage that you take a few minutes to visit with us. The chat space is reserved exclusively for paid subscribers and the discussion continues to pick up every week - interesting questions being asked and answered, growing community engagement and real-time access to Beachman and his portfolio actions during market hours. During times like these, when markets are volatile to the downside, engaging with a community of smart investors is especially valuable.

Even if you do not feel like contributing, it’s ok to stop by, peruse the dialogue and get a feel for the sentiment among the Beachman community.

Market signals

Markets did some major repair by close on Friday. We had flagged several areas of support as you can see on the SP500 chart below. After a terrible prior Fri and a tumultuous Mon, the indexes closed higher for 3 of the last 4 days…the SP500, the NDX and the Mag7.

We saw declining volume with more buyers than sellers along with a recovering RSI. Higher highs and higher lows.

That said, market conditions remain on edge. Take a look at these 4 visuals below.

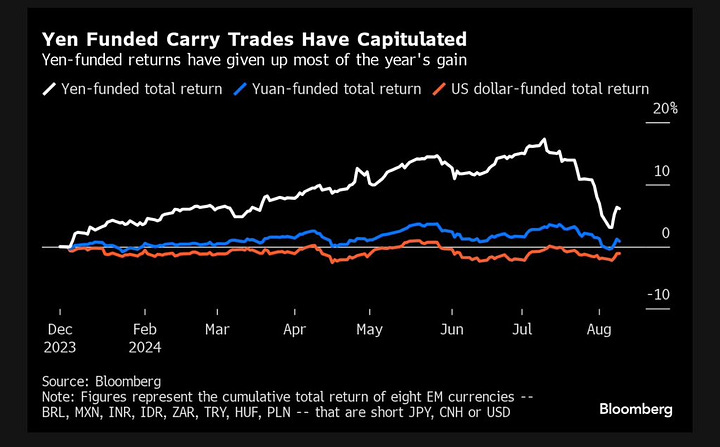

As WSJ puts it, “They built over months: big bets on the Japanese yen. Complex cryptocurrency wagers. Investments in hot tech companies. Common to all the trades were heavy doses of leverage, or borrowed money, which investors used to amplify expected gains. As markets rose through the first half of 2024, the investments generated windfall profits, inspiring copycat traders to get on board and pushing prices higher.”

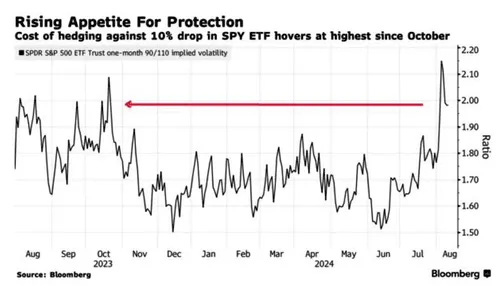

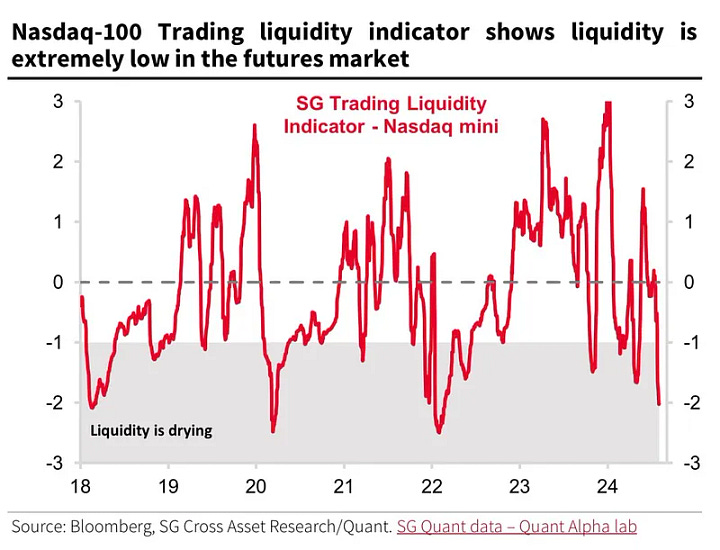

These over-their-skis trades have quickly gotten cleared out. Traders are putting more hedges in place. Their positioning in equities has dropped considerably and trading liquidity has tanked. Folks are still cautious out there and searching for green shoots.

Looking ahead, there is a lot of macro stuff coming up. Small business NFIB index report that will tell us about the health of small businesses. Wholesale inflation (PPI) report and retail inflation (CPI) report. Aug monthly options expiry. Markets could remain volatile based on these events, especially Wed and Thu, and will look to find support at the levels marked on the SP500 chart above.

We need to stay on our toes. Be like water…

Beachman’s plan

Given the market signals that I discussed above…

…my simple, actionable, measurable investing plan is as follows: