Beachman's investing plan - Special edition Jul 26 2024

Portfolio: What I am planning to do in the markets and with my portfolio

Three days ago, I wrote about how markets have been feeling different over the past couple of weeks. How fear and doubt has crept into the mindset of investors and traders. How we needed to acknowledge and allow markets to take a breather. How we needed to go back to lessons learned from 2022 when our portfolios started taking major hits as interest rates were getting hiked. How we needed to develop a plan for our portfolios and follow said plan - sells, trims, buys….keeping a longer term focus in mind…taking into consideration the fundamentals of the companies we are interested in owning, extrapolating the forward business potential of these stocks, ignoring the chaos and noise of the present, setting ourselves up for success in the future.

After watching how markets behaved yesterday…I have come to the conclusion that we are close to the end of this mini-correction and it is time to buy the dip.

Yup, I am buying the dip.

Here is why.

Here is what.

Here is how.

Table of contents

Market signals

Beachman’s pivot plan

Join us on the daily chat

I continue to hear from paid subscribers that our chat line is one of the most useful features of my substack.

If you have not joined us on the chat line here, I highly encourage that you take a few minutes to visit with us.

The chat space is reserved exclusively for paid subscribers and the discussion continues to pick up every week - interesting questions being asked and answered, growing community engagement and real-time access to Beachman and his portfolio actions during market hours. During times like these, when markets are volatile to the downside, engaging with a community of smart investors is especially valuable.

Even if you do not feel like contributing, it’s ok to stop by, peruse the dialogue and get a feel for the sentiment among the Beachman community.

Market signals

After the SP500 lost about -5% from its all time high and the NDX (Nasdaq100) lost about -9% from its all time high, markets are now at major support levels.

The SP500 is oversold and due for a bounce higher. It has very strong support at 5,350…at 5,300…at 5,250 and at 5,200. Below 5,200, we will be in trouble and could go as low as 5,000. For now we are at strong support levels.

Similarly, the NDX is oversold and finding support at 18,800…at 18,650 and at 18,450.

Options markets continue to tilt towards bullish CALL options. This means that market makers who handle about 90% of options trades have to hedge their positions by buying the underlying stock. This is one of the biggest reasons why yesterday, Thu Jul 24th, markets started “fighting” back against the bears, all day…except into the close.

In fact, the flush lower into the close was likely the final straw that broke the camel’s back. This could be close to exhausting the sellers and energizing the buyers going forward.

The Fear and Greed index is at Fear levels, signaling that a mean reversion back higher is nigh. Ideally, we want to be at Extreme Fear levels before buying the dip…but then we might not get there and more importantly, we are not trying to time the market.

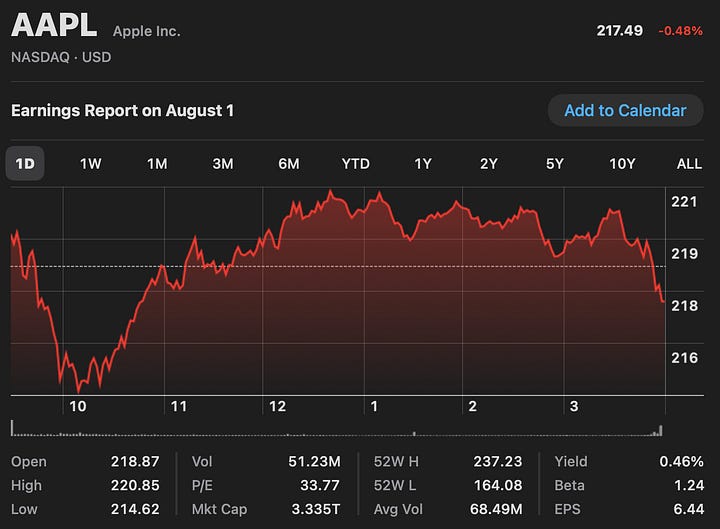

Finally, the two generals in this market are AAPL and NVDA. As they go, so goes the general tone of the market. Today, both these captains closed the day with very thin, flat candles…meaning there was a major tug-of-war between the bears and the bulls for these stocks. Neither side won. These stocks opened and closed within a $1-2 range.

All these signals collectively are making me more confident that markets are close to being done with their move lower. The downside energy has been released. Selling exhaustion is close and it is time to buy the dip.

Buying is always harder on days like today…during times like these when our screens are awash in red. However, these buys usually end up being some of the most beautiful, profitable buys in an investor’s lifetime.

Just ask anyone who bought NVDA on Oct 13th 2022 at a split adjusted price of $10.81.

Beachman’s pivot plan

Given the market signals that I discussed above…

…my simple, actionable, measurable investing plan is as follows: